By FXEmpire.com

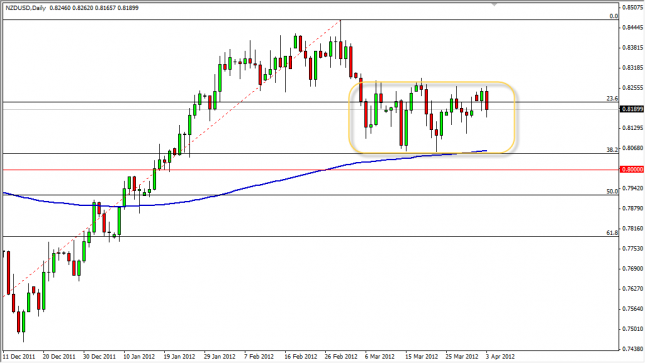

The NZD/USD pair fell on Tuesday as the Federal Reserve minutes gave no real hint of continued easing by the central bank. With this in mind, it sent traders into the Dollar as it appears many of them expected continued easing. The pair failed at the 0.8250 level again, and it now looks like we are going to continue to consolidate in the immediate area.

We see support at the 0.8050 level, and the 200 day EMA is in the area as well. Because of this, and the fact that the 38.2% Fibonacci level is in the same spot, we expect any selloff in this pair to be temporary. In fact, we are going to let this pair pullback and buy supportive action if we find it. A break below the 0.80 level would of course concern the bulls, and could send this pair much lower.

NZD/USD Forecast April 4, 2012, Technical Analysis

Originally posted here