By FXEmpire.com

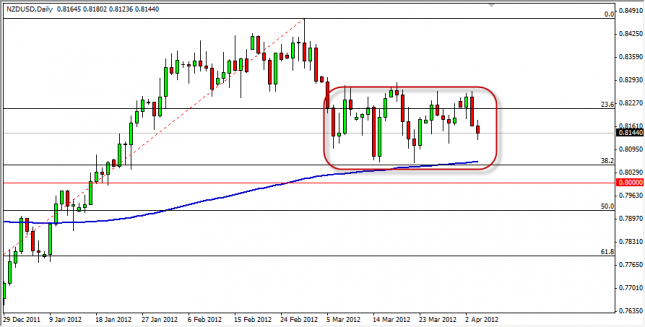

The NZD/USD pair fell during the session on Wednesday, but managed a bit of a bounce in the end. The resulting candle is a doji, which looks a bit like a hammer as well. The market looks like it is trying to soften up a bit, and the support may be coming into play just below. Because of this, we are waiting to see those areas come into play. The 200 day EMA is just below as well, and this could be supportive too. The 0.80 level is sandwiched between the 38.2% and 50% Fibonacci levels, so we think in that neighborhood we could see a buy signal. In the mean time, we are simply waiting for supportive candles to buy in this area. If we can close below the 50% Fibonacci level, we would consider selling.

NZD/USD Forecast April 5, 2012, Technical Analysis

Originally posted here