By FXEmpire.com

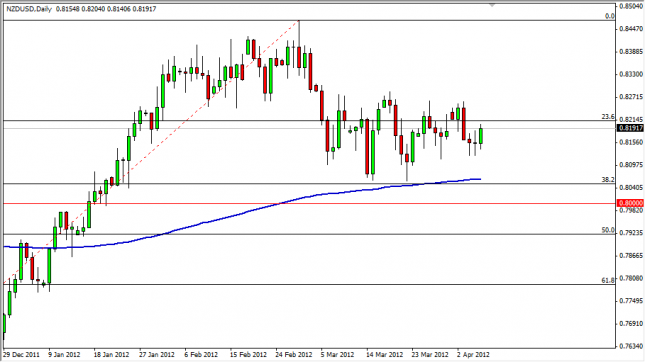

The NZD/USD pair rose during the session on Friday as the Non-Farm Payroll came out lighter than expected. The 200 day EAM is just below, and so is the 38.2% Fibonacci level. With the recent action – we know that the support is below, so we are more apt to be long of this pair. This is especially true as the trend is most certainly up as well.

The 0.8250 level above is resistance, but we think sooner or later it will give way as the trend continues. When looking at the recent action, it seems we are simply taking a breather before the next leg. We are willing to buy at the 0.8050 level and at a break of the 82.50 level as well. Selling isn’t a thought until we get below the 79.50 level.

NZD/USD Forecast April 9, 2012, Technical Analysis

Originally posted here