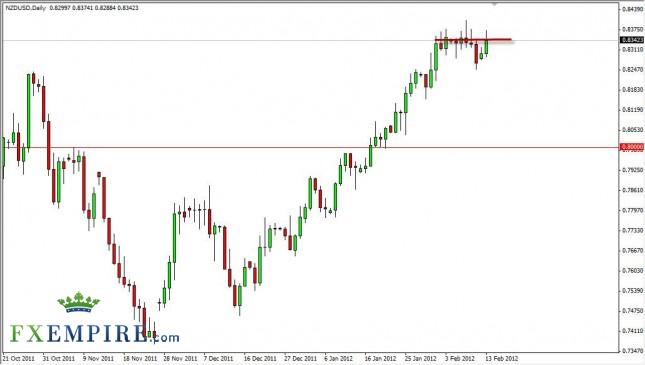

The Greek austerity vote passing put a bit of a bid in the “risk on” attitude of markets around the world on Monday. The Kiwi dollar always likes risk appetite, and as a result we saw this pair rise during the session overall. The pair did find the 0.8350 level as resistive, and pulled back because of it at the end of the session.

The pair had found the area to be a focal point recently as the pair went sideways all last week around the level. The pair is highly tied to commodities, especially agricultural ones, and as a result it is important to pay attention to the futures markets as well as this chart. With the lackluster reaction to the Greeks passing the votes in general though, it is hard not to wonder how long this positive tone will continue in the markets.

The level is currently sits at could very well act as resistance, and as a consequence, we are willing to wait until the shooting star from the Wednesday session of last week gets violated to the upside in order to buy this pair. The fact is that there are a lot of headline risks out there and as a condition of going long in this pair – we need to have some support under us as protection.

The pair looked fairly impressive on Monday, but there were many that normally move in correlation that were less than impressive and this has us cautious in general. The markets have moved in a correlated manner over the last few years so this needs to be paid attention to. The EUR/USD is a great pair to watch for sentiment, and it should be said that the “risk on” sentiment seems to have faded by the end of the session. So while we have a very bullish looking chart in the Kiwi, we aren’t quite ready to jump into the pair at this moment as there are too many risks possible without that aforementioned support. We don’t want to sell either; the move has been too strong to the upside for that.

NZD/USD Forecast February 14, 2012, Technical Analysis

Originally posted here