By FXEmpire.com

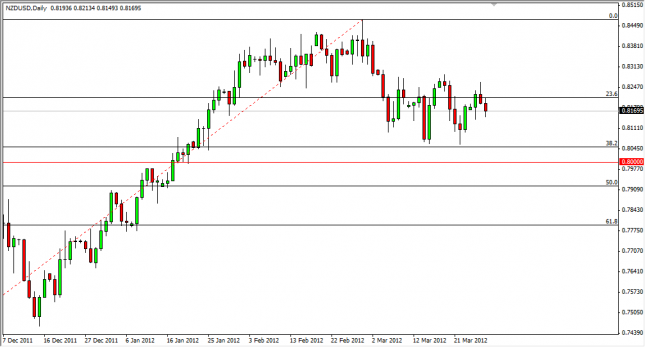

The NZD/USD pair fell on Wednesday as the “risk off” trade came back into play. The Kiwi fell below the Tuesday range, setting off a sell signal as the candle from the session was a shooting star. However, the market is certainly in an uptrend, and this would be countertrend in nature. This of course has us very careful about taking moves like this.

The daily candle looks a bit like a hammer, and this is enough for us to close out the position and take a small profit. Sometimes, the markets simply have no real follow through, and experience has told us that it is better to bail on a position with a small gain instead of trying to push things when going countertrend. Remember, if we were long – then we would have a massive amount of buying pressure below us. However, as we are not, it is hard to ignore the little bit of a bounce, after the fall from the earlier part of the session on Wednesday.

The recent action in this market has been very consolidative, and a break below the bottom of the hammer from the session on Wednesday has us selling again as the market would be heading below to roughly the .8050 level or so. The breaking below of that level will be very difficult as the 0.80 level is a major psychological round number, and the 50% Fibonacci retracement level is just below that mark. It isn’t until we are below the 79.50 level that we feel the uptrend is breaking down.

Because of this, we are buying this pair on the whole, and using dips to do it. In fact, if the pair does fall, we are willing to close our sell position around the 0.81 level, and look for a supportive candle to buy from as the area below is so obviously support. The oil and other commodity markets will have to be watched as well, as they almost always has an effect on the NZD/USD markets.

NZD/USD Forecast March 29, 2012, Technical Analysis

Originally posted here