By FXEmpire.com

NZD/USD Fundamental Analysis April 9, 2012, Forecast

Analysis and Recommendation: (close of the Asian session)

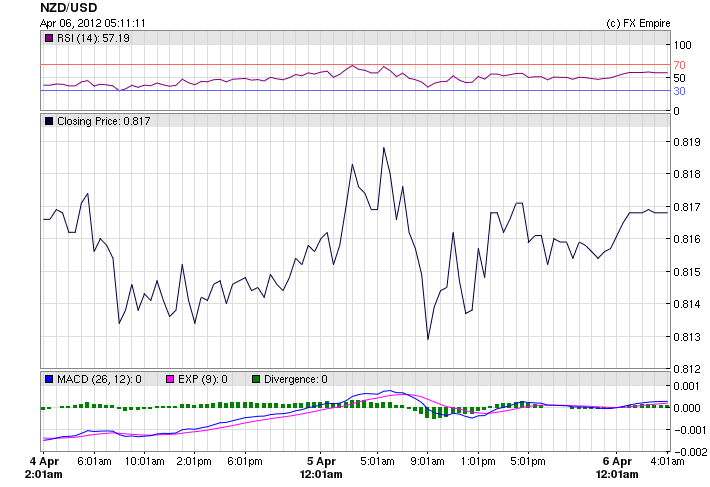

NZD/USD was trading at 0.8154, down 0.09% during the Asian session.

The pair was likely to find support at 0.8125, Wednesday’s low, and resistance at 0.8263, Tuesday’s high.

A rally on Chinese equity markets has helped the Australian dollar to recover from a three month low.

The New Zealand dollar has eased after weak demand at a Spanish bond auction caused stocks on Wall Street to fall, reigniting fears the region’s sovereign-debt crisis is far from over.

The New Zealand dollar fell to 81.40 US cents at 8am from 81.60 cents yesterday at 5pm.

Tepid demand at a Spanish government bond auction spooked investors who had been upbeat about global growth prospects and sparked a sell-off in higher-yielding, or riskier, assets.

Reflecting the negative risk sentiment, the safe-haven US dollar and Japanese Yen strengthened against all of the major currencies pushing the kiwi dollar down.

Most Western Markets are Closed on Friday April 6, 2012 and many are Closed on Monday April 9, 2012.

Economic Events April 5, 2012 actual v. forecast

|

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

GBP |

Manufacturing Production |

-1.0% |

0.1% |

-0.3% |

|

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

GBP |

BOE QE Total |

325B |

325B |

325B |

|

BRL |

Brazilian CPI (YoY) |

5.2% |

5.4% |

5.8% |

|

Building Permits (MoM) |

7.5% |

3.0% |

-11.4% |

|

|

CAD |

Employment Change |

82.3K |

10.0K |

-2.8K |

|

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

CAD |

Unemployment Rate |

7.2% |

8.0% |

7.4% |

|

USD |

Continuing Jobless Claims |

3338K |

3350K |

3354K |

|

CAD |

Ivey PMI |

63.5 |

66.0 |

66.5 |

|

GBP |

NIESR GDP Estimate |

0.1% |

0.1% |

Economic Events scheduled for April 9, 2012

02:30 CNY Chinese CPI (YoY) 3.3% 3.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

02:30 CNY Chinese PPI (YoY) -0.2%

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

10:00 EUR Greek CPI (YoY) 2.10%

Consumer Price index is the most frequently used indicator of inflation and reflect changes in the cost of acquiring a fixed basket of goods and services by the average consumer.

Originally posted here