By FX Empire.com

NZD/USD Fundamental Analysis March 14, 2012, Forecast

Analysis and Recommendation: (close of the Asian session)

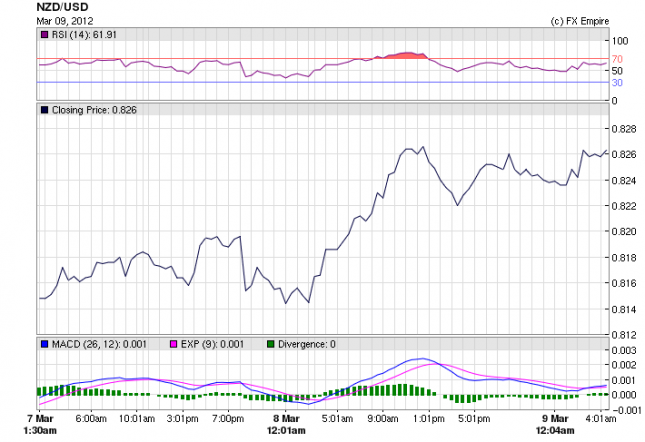

NZD/USD opened this morning at 0.8180 and has climbed to 0.8228. Like its other commodity partners, the USD is down as investors prepare for the US FOMC decision and statements. The markets have been relatively quiet and will remain so most of the day waiting on the Feds.

Economic Data March 12-13, 2012 actual v. forecast

|

08:00 |

EUR |

German WPI (MoM) |

1.0% |

1.1% |

1.2% |

|

|

10:00 |

EUR |

Italian GDP (QoQ) |

-0.7% |

-0.7% |

-0.7% |

|

|

11:30 |

EUR |

German 6-Month Bubill Auction |

0.053% |

0.076% |

||

|

12:00 |

ALL |

OECD Composite Leading Indicators |

100.9 |

100.6 |

100.5 |

|

|

16:30 |

USD |

3-Month Bill Auction |

0.095% |

0.080% |

||

|

19:00 |

USD |

Federal Budget Balance |

-231.7B |

-229.3B |

-27.4B |

|

|

22:45 |

NZD |

FPI (MoM) |

0.6% |

0.0% |

||

|

Mar. 13 |

00:50 |

JPY |

Tertiary Industry Activity Index (MoM) |

-1.7% |

0.4% |

1.8% |

|

01:01 |

GBP |

RICS House Price Balance |

-13% |

-14% |

-16% |

|

|

01:30 |

AUD |

Home Loans (MoM) |

-1.2% |

-0.1% |

2.1% |

|

|

01:30 |

AUD |

NAB Business Confidence |

1 |

4 |

JUST RELEASED

“Overseas economies still have not emerged from a deceleration phase on the whole but some improvement has recently been observed in the U.S. economy and the sluggish European economy has stopped deteriorating,” the central bank said. The BoJ kept key rates and also announced it would increase the amount of loans available through its growth supporting facility by 2 trillion yen ($24.35 billion)

Upcoming Economic Events that effect the AUS, NZD and the JPY

00:30 AUD Westpac Consumer Sentiment 4.20%

The Westpac Consumer Sentiment Index measures the change in the level of consumer confidence in economic activity. On the index, a level above 100.0 indicates optimism; below indicates pessimism. The data is compiled from a survey of about 1,200 consumers which asks respondents to rate the relative level of past and future economic conditions.

00:50 JPY BSI Large Manufacturing Conditions 1.3 -6.1

The Business Sentiment Index (BSI) Large Manufacturing Conditions Index measures business sentiment in manufacturing. The data is derived from a survey of large Japanese manufacturers. It is a key indicator of the strength of the Japanese economy, which relies heavily on the manufacturing industry. A level above zero indicates improving conditions; a level below indicates worsening conditions. This survey may help to predict the Bank of Japan’s Tankan Large Manufacturing Index which is generally released about a week later.

05:30 JPY Industrial Production (MoM) 2.1% 2.0%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

06:00 JPY BoJ Monthly Report

The Bank of Japan’s (BoJ) monthly report contains the statistical data that policymakers evaluate when setting interest rates. The report also provides detailed analysis of current and future economic conditions from the bank’s perspective

13:30 USD Current Account -114.0B -110.0B

The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the nation’s exports the data can have a sizable affect on the USD.

13:30 USD Import Price Index (MoM) 0.6% 0.3%

The Import Price Index measures the change in the price of imported goods and services purchased domestically.

15:00 USD Fed Chairman Bernanke Speaks

Federal Reserve Chairman Ben Bernanke (February 2006 – January 2014) is to speak. As head of the Fed, which controls short term interest rates, he has more influence over the U.S. dollar’s value than any other person. Traders closely watch his speeches as they are often used to drop hints regarding future monetary policy

Government Bond Auction Schedule (this week)

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here