By FXEmpire.com

NZD/USD Fundamental Analysis March 22, 2012, Forecast

Analysis and Recommendation: (close of the Asian session)

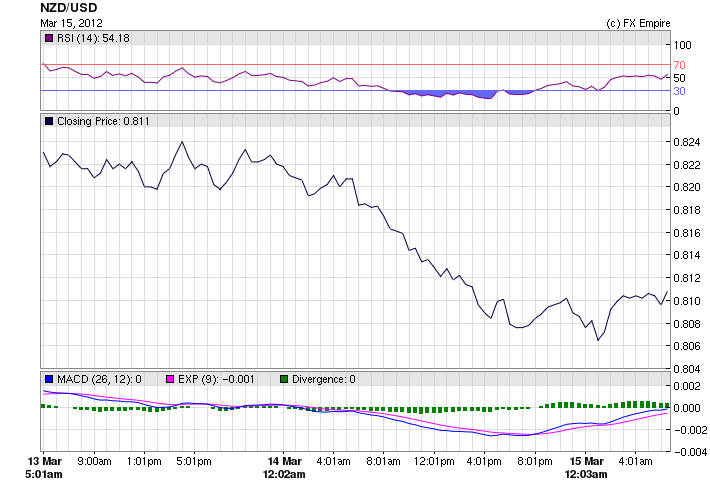

The NZD/USD reduced losses through the local trading session on optimism Europe’s sovereign debt woes are receding and after government figures showed the local current account deficit narrowed in the tail-end of last year. Positive economic data, is the obvious driver today for the kiwi, as the global markets are worried about a slowdown in China, which is hurting all of the commodity currencies. New Zealand depends on Chinese trade for a large part of its economy.

The kiwi rose to 81.89 US cents at 5pm from 81.66 cents at 8am, paring its loss from yesterday when it traded at 82.44 cents.

The NZD fell yesterday after BHP Billiton, the world’s largest mining company, warned Chinese demand for iron ore was flattening out, and dairy prices on Fonterra Cooperative Groups online trading platform dropped 4.5% to an eight-month low.

New Zealand government figures showed a narrower current account deficit of $2.09 billion than expected in the three months ended December 31, amid record exports of dairy products and smaller dividends paid out to foreigners. The annual gap shrank to $8.3 billion, or 4% of gross domestic product.

Tomorrow’s fourth-quarter GDP figures, which are expected to show New Zealand’s economy grew at a pace of 0.6% in the period.

Economic Events and Reports March 20, 2012 actual v. forecast

|

Mar. 20 |

AUD |

Monetary Policy Meeting Minutes |

||

|

CHF |

Industrial Production (QoQ) |

7.9% |

0.4% |

-2.0% |

|

GBP |

Core CPI (YoY) |

2.4% |

2.4% |

2.6% |

|

GBP |

CPI (YoY) |

3.4% |

3.4% |

3.6% |

|

GBP |

CBI Industrial Trends Orders |

-8 |

-5 |

-3 |

|

USD |

Building Permits |

0.72M |

0.69M |

0.68M |

|

USD |

Housing Starts |

0.70M |

0.70M |

0.71M |

|

NZD |

Current Account |

-2.76B |

-2.83B |

-4.75B |

Economic Events Scheduled for March 21, 2012 affecting AUD, NZD and JPY

00:50 JPY Trade Balance

The Trade Balance measures the difference in value between imported and exported goods and services over the reported period. A positive number indicates that more goods and services were exported than imported.

13:30 USD Initial Jobless Claims

13:30 USD Continuing Jobless Claims

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance.

Government Bond Auctions (this week)

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here