By FXEmpire.com

NZD/USD Weekly Fundamental Analysis March 26-30, 2012, Forecast

Introduction: The recent strength of the kiwi, a currency sometimes overlooked by traders, made its moves much more predictable. This applies to support and resistance lines alike. This is a very safe pair to trade, not a great deal of volatility but predictability.

Analysis and Recommendation:

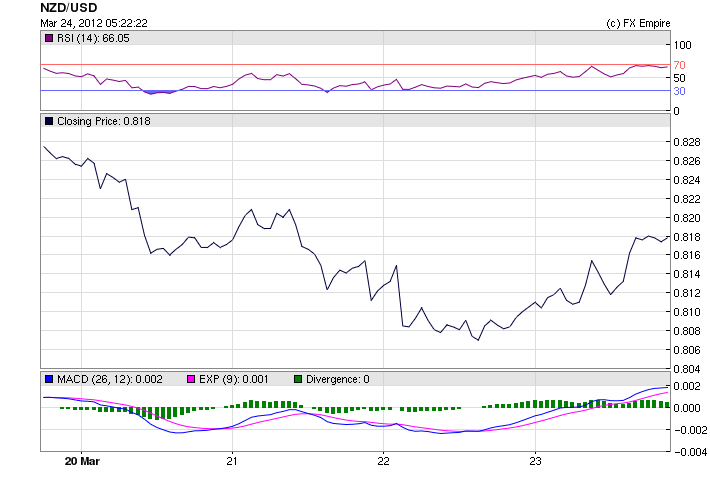

NZD/USD is trading at 0.8182 after a bumpy week after investors received upsetting news, as the GDP report showed an increase of only 0.3% while the markets had been expecting 0.6%. This compounded with the negative news from China sent the kiwi down to a low for the week of 0.8059. When just a day before tourist information showed that tourism had exceeded forecast and the kiwi was up at 0.8288. We can expect the kiwi to remain range bound in early trading this week

Otherwise this week had very little in the way of economic data. Australia was under pressure as everything was blamed on the RBA. The overall drop in the Asian markets was in response to the worries over a possible slowdown in China and negative reports over the past few weeks. Investors seemed to turn their attention this week after comments from mining companies.

New Zealand reported a lowered then forecast GDP the day after, they reported above forecast of travelers and expenditures.

Japan, continues to be full of surprises. Japan swung back to a trade surplus in February, defying expectations for a deficit as shipments to the U.S. jumped. Japan logged a 32.9 billion yen ($395 million) surplus from the month, after January’s ?1.475 trillion deficit, the Ministry reported today.

A host of important economic indicators are due in the week ahead set to grab the attention of investors.

On Monday, Japan will release retail sales.

In Australia, job vacancies data is due, while the Reserve Bank will release its biannual financial stability review.

Reserve Bank assistant governor Guy Debelle will speak at a corporate function this week, while Productivity Commission chairman Gary Banks will also speak.

On Tuesday, Reserve Bank of Australia assistant governor Guy Debelle will speak at the Morgan Stanley Global Macro Investment Conference in Sydney.

Wednesday sees the RBA release its biannual financial stability review, which will outline the central bank’s assessment of the health of Australia’s financial system..

New Zealand will release total building permits.

On Thursday, the Australian Bureau of Statistics will release job vacancies data for February.

Friday sees RP Data and Rismark release their latest home price data figures, while private sector credit data for February is also due from the ABS. The figures are expected to show a 0.2 % rise in credit for the month.

The Australian housing industry association will release new home sales data for February.

Friday is the big day for Japanese data, with the unemployment rate, followed by Core CPI and Industrial production.

Last week’s highlights from around the globe:

The good:

Initial Jobless Claims fall to 348k, the lowest since Mar ’08 a drop of 5000 under forecast.

Multifamily housing starts jump again in Feb and permits rise to the most since Oct ’08.

Greek CDS payments clear smoothly. Greek Default date passes.

Portuguese 10 yr bond yield falls 108 bps in spite of concerns with it post Greece.

French business confidence rises 3 pts to a 4 month high

The not so bad:

China slowdown concerns grow.

HSBC preliminary manufacturers fall to 48.1 from 49.6, 5th month below 50.

More cities report home price decreases and fewer report home price increases.

BHP and Rio express reservations over pace of Chinese growth.

Official at China Assoc of Auto Mfr’s says auto sales likely to miss their estimates in 2012.

China raises gasoline and diesel prices.

Spanish and Italian 10 yr yields rise almost 20 bps on the week.

German and French manufacturers PMI fall back below 50.

Euro zone manufacturers and services composite index unexpectedly falls to 48.7 from 49.3.

UK retail sales below estimates and consumer confidence falls.

Feb US New Home Sales unexpectedly drop to 313k, a still anemic level and months’ supply up a touch to 5.8 from 5.7.

Existing Home Sales month’s supply rises to 6.4 from 6.0. Feb sales light but Jan revised up.

NAHB home builder survey unchanged at 28 vs. estimate of 30.

Single family housing starts flat, seeing no weather induced improvement.

Historical

Highest: 0.8816 USD on 31 Jul 2011.

Average: 0.7543 USD over this period.

Lowest: 0.6619 USD on 07 Jun 2010.

Economic Highlights of the coming week that affect the Yen, the Aussie and the Kiwi.

|

Mar. 26 |

00:50 |

JPY |

Retail Sales (YoY) |

|

15:00 |

USD |

Pending Home Sales (MoM) |

|

|

Mar. 27 |

15:00 |

USD |

CB Consumer Confidence |

|

17:45 |

USD |

Fed Chairman Bernanke Speaks |

|

|

Mar. 28 |

01:30 |

AUD |

RBA Financial Stability Review |

|

13:30 |

USD |

Durable Goods Orders (MoM) |

|

|

Mar. 29 |

13:30 |

USD |

Initial Jobless Claims |

|

13:30 |

USD |

GDP (QoQ) |

|

|

17:45 |

USD |

Fed Chairman Bernanke Speaks |

|

|

22:45 |

NZD |

Building Consents (MoM) |

|

|

Mar. 30 |

00:30 |

JPY |

Unemployment Rate |

|

00:30 |

JPY |

Tokyo Core CPI (YoY) |

|

|

00:50 |

JPY |

Industrial Production (MoM) |

|

|

00:50 |

JPY |

Tankan Large Manufacturers Index |

|

|

13:30 |

USD |

Core PCE Price Index (MoM) |

|

|

13:30 |

USD |

Personal Spending (MoM) |

|

|

14:45 |

USD |

Chicago PMI |

|

|

14:55 |

USD |

Michigan Consumer Sentiment Index |

Government Bond Auctions (this week)

Mar 26 09:10 Norway Nok 3.0bn NST 474 3.75% May 2021 Bond

Mar 26 10:30 Germany Eur 3.0bn new Mar 2013 Bubill

Mar 26 15:30 Italy Details BTP/CCTeu auction on Mar 29

Mar 27 09:10 Italy CTZ/BTPei auction

Mar 27 08:30 Spain 3 & 6M T-bill auction

Mar 27 17:00 US Auctions 2Y Notes

Mar 28 09:10 Italy BOT auction

Mar 28 17:00 US Auctions 3Y Notes

Mar 29 09:10 Italy BTP/CCTeu auction

Mar 29 17:00 US Auctions 7Y Notes

Originally posted here