By FXEmpire.com

The Light Sweet Crude markets have been selling off lately, based upon the premise of a slower economy around the world. The demand for oil is fairly strong in some parts of the world, but weak in others. The US dollar was increasing in value, and as this market is based in those same Dollars – it makes sense that it has been falling.

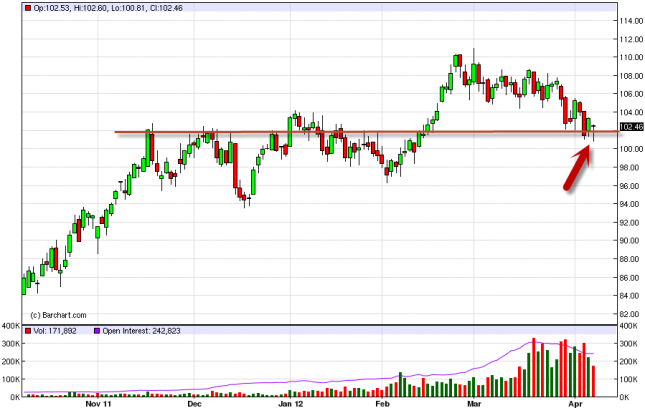

The $100 level is of course an important area, as it is a large round psychologically important number. The area goes down to the $95 level for support, and as a result we aren’t inclined to sell at this point regardless. But the session on Monday saw the fall only to bounce. The candle for the session is a hammer, and formed just above the $100 level.

The hammer is formed at an area that we were looking for support to happen. The market has been oversold recently, and with the Iranians looking to talk with the Americans now, it pushed prices lower. However, as the past has shown us, this is unlikely to produce much of a solution for the longer term. The market likes to bounce around between $10 levels, and this could be setting up for a nice range between $100 and $110.

The market has far too many levels of support below for us to think about selling, as the $95 mark isn’t the only one, rather a stronger one than the other multitudes of minor support levels. The longer term action is certainly to the upside, and when we see all of this support, it makes sense to be biased to the upside.

The upside will be a struggle, but when weighing all options, and the hammer be formed for the session leads us to believe that the real risk in this market is to the upside, especially with all of the potential headlines that could come out of Iran. The selling of this market is almost impossible at this point, but we are willing to buy on a break above the Monday highs, expecting to have a grind higher, not a straight shot.

Oil Forecast April 10, 2012, Technical Analysis

Originally posted here