By FXEmpire.com

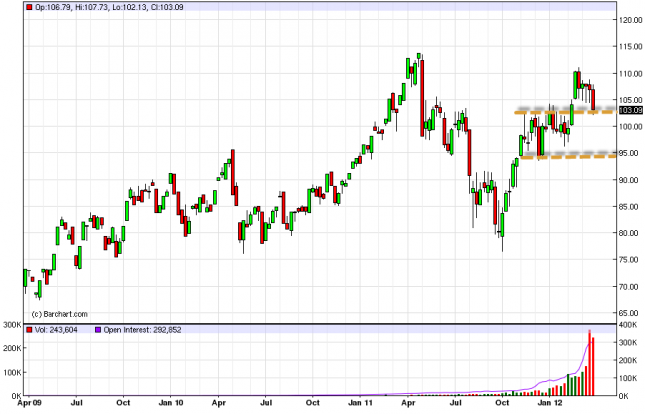

The Light Sweet Crude markets pulled back for the week as the rumors of a release of Strategic Petroleum Reserves in the United States, France, and the United Kingdom came out. These are just rumors, and no official word has been released about this at this point in time. The market fell quickly, but we should remember that the last time the SPR was released in the United States, the price of Crude only fell for seven trading sessions. With this in mind, we as bulls of the oil markets welcome this attempt as an easy way to get involved in this market at lower prices.

The $102 to $95 area is extremely congested at this point, and we feel that somewhere in this mess we will see support. There are multiple areas that could serve as such, and we think that a release of the SPRs will push prices into this area to look for it. It is upon a supportive candle in the area that we are willing to buy the Light Sweet Crude contract as we see demand as being robust, especially in emerging markets like China and India.

On a hammer or bullish engulfing candle we are buyers of this market. We also are willing to enter the market based off of the daily chart in order to get involved in a longer-term trend. Think of it as “tweaking” the entry to maximize profits. Obviously, we are thinking long only, as the trend has been strong over the last several years.

If the market moves back above $105, we expect to see $110 in short order, and would be willing to add to any longs above that level as well. The $115 level will be an area that we see serious resistance as well, but wouldn’t be surprised to see in the near future. As for selling, it isn’t even a thought until we manage to break the bottom of the noise below, which we would see as a daily close below the $95 level.

Oil Forecast for the Week of April 2, 2012, Technical Analysis

Originally posted here