By FX Empire.com

The Light Sweet Crude markets fell during the lackluster session on Monday as traders are more than likely awaiting the crucial FMOC statement out of the United States later today. The statement shouldn’t be a surprise in the sense of rates – they will be left alone – rather, traders are looking to see whether or not any mention is made of a possible QE3 in the cards. Quantitative easing would be very bullish for commodities and negative for the Dollar. During a recent Congressional hearing, Mr. Bernanke made no mention of the possibility of QE3, and the stock markets as well as other risk assets fell in value as a result.

The oil markets will continue to have a bid in them though, as the Middle East, and Iran in particular, will continue to offer plenty of reasons to have oil rise in value. The standoff between Iran and the West continues to go nowhere, and there is concern that the Israelis will launch an attack on the Iranians, flaring tensions. Iran has threatened to block the Strait of Hormuz if attacked, but in reality this would only cause a very short-term spike in price as the US Navy will open the passage in short order if closed.

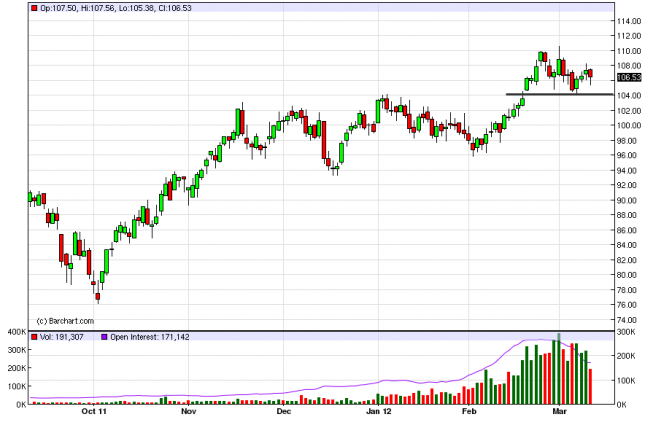

The candle for the Monday’s session formed a hammer just above the $104 level that has been serving as support over the recent sessions. The market still looks bullish, and as long as the $104 level holds, the market is more likely to break higher than lower. With the FMOC meeting later today, there is a chance that Mr. Bernanke could be the catalyst to higher prices. However, if he doesn’t suggest that QE3 is a possibility, we may see the Dollar rise, and all commodities fall. Oil won’t be any different, except the fact that there are a plethora of other reasons this market will go higher.

If the recent highs are broken, the market will rise to $110, and on to the $115 level. If the market pulls back after the FMOC statement, we will be buying on the first sign of support as the market still has more to worry about than the interest rates out of the USA. We won’t sell at this point in time, and it isn’t a thought until we are below the $95 level.

Oil Forecast March 13, 2012, Technical Analysis

Originally posted here