The Light Sweet Crude markets fell during the session as the “risk off” trade came back on. The move in the markets were at one point exacerbated by a Reuters report that the United States and Britain had agreed to release petroleum reserves from the SPR, or Strategic Petroleum Reserves in order to help alleviate the bullish pressure on prices. With the Middle East and all of its troubles, there has been a bid in this market overall as a result.

However, shortly after this report was released, the White House denied that any agreement had been reached, and the price of oil bounced from the initial fall. In retrospect, many of the traders were probably looking to buy this fall as the last time the SPR was released back in June; the price was back to where it had started in just 7 short days. More than likely, any release of the SPR going forward will have more to do with the election in November than any real attempt to lower prices for the long run.

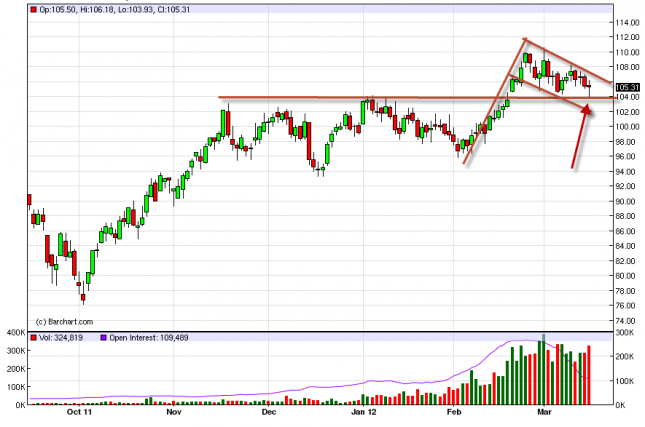

The flag that we have been talking about is still there, and the bounce came from the $104 level as well, so this shows the lower part of our range to be very supportive as a result. We like the area as support, and as a result still like the market as a whole. The candle for the Thursday session is a hammer, and this shows support as well.

The situation in Iran is showing no real signs of letting up, and this will continue to push prices higher over time. The recent flag suggest that we could run as high as $122 based upon the “pole” of the flag, and as a result we like not only buying a breakout higher, but holding onto it for a run all the way up to our target. We will buy this market if we break the top of the Thursday session, knowing sully that the $110 level will more than likely offer some kind of resistance albeit minor. We have no intention of shorting this market presently.

Oil Forecast March 16, 2012, Technical Analysis

Originally posted here