The prospect of an armed confrontation with Syria sent crude prices soaring on Tuesday, with U.S. oil ending just shy of a new 2013 high as traders possibly positioned for a new Middle East conflict.

BIG MOVES

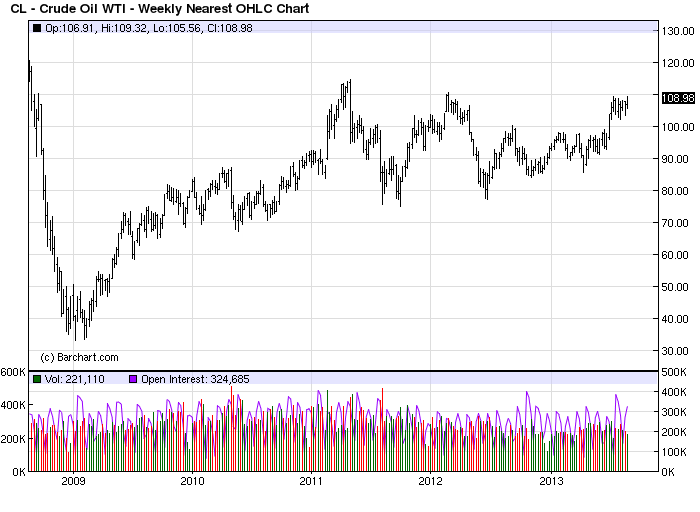

Fears of regional instability that could strangle oil supplies sent both Brent and West Texas Intermediate rallying to new yearly highs during Tuesday’s session, as speculation churned about an intervention in Syria. Traders spurred October crude futures, or WTI, to a new 2013 high at $109.32, before it cooled gains to settle at $109.01. That was its highest since February 24, 2012.

HOW MUCH DOES SYRIAN OIL PRODUCTION MATTER?

Syria ranks among the smallest oil producing nations in the Middle East, with International Energy Agency data listing the country as 32nd among global oil producers. However, with instability already roiling the region and raising widespread fears about supply, analysts say a new conflict could have a domino effect to other neighboring nations while disrupting global supply lines and production

The market has found an underlying bid above $100.00 a barrel for weeks without the fears of geo-political tension of this nature. However recent fears of unrest in Egypt and before that in Libya certainly have been a deterrent for a pullback for crude. Technically the market has made lower highs on each pullback only to trade higher. Those who read my recent TraderPlanet article may have been rewarded as I called buying the October crude 110 call and selling the 112 call for a spread price of 35 cents.

LOOKING AHEAD

It is my view that the market looks like it could be possibly filling a gap all the way up to the 2011 high of $113.89. Therefore I am proposing the following trade.

SPREAD PLAY

Provided that the market dips in the next few sessions providing a buying opportunity, I will look at a classic spread opportunity. I will look at buying the November Crude Oil 115 call and selling the November Crude 120 call for a purchase price of 55 cents or a cost of $550.00, in what is referred as a bull call spread. The risk on the trade is the price paid for the spread which in this case is $550.00, plus all commissions and fees. I will use the aforementioned 113.89 level as a target and if achieved will most likely exit the spread. The maximum one could collect on this trade is $5,000.00, if both strikes finish in the money at the time of expiration.

NEVER SAY NEVER

This scenario in my view is unlikely but in my many years of experience, you never say never when dealing with commodities.

= = =

Please call or email me with questions or comments at anytime and to be added to my daily report blog. Also for those of you interested in grains, please join Walsh Trading’s senior grain analyst, Tim Hannagan, for his weekly webinar series every Thursday at 3pm central time.

RISK DISCLOSURE: THERE IS A SUBSTANTIAL RISK OF LOSS IN FUTURES AND OPTIONS TRADING. THIS REPORT IS A SOLICITATION FOR ENTERING A DERIVATIVES TRANSACTION AND ALL TRANSACTIONS INCLUDE A SUBSTANTIAL RISK OF LOSS. THE USE OF A STOP-LOSS ORDER MAY NOT NECESSARILY LIMIT YOUR LOSS TO THE INTENDED AMOUNT. WHILE CURRENT EVENTS, MARKET ANNOUNCEMENTS AND SEASONAL FACTORS ARE TYPICALLY BUILT INTO FUTURES PRICES, A MOVEMENT IN THE CASH MARKET WOULD NOT NECESSARILY MOVE IN TANDEM WITH THE RELATED FUTURES AND OPTIONS CONTRACTS.