Oil prices rose 8.3% for the week ending April 22nd. As we head in to the next week there in increasing ideas that the worst is over and that price rebalancing is beginning to occur. Some analysts still believe that the market will still a distance away from rebalancing.

“While this recent rally has the potential to run further to the upside … we believe that it is not yet driven by a sustainable shift in fundamentals,” Goldman Sachs (NYSE:GS) said in a note to clients.

Despite the recent rally, oil markets remain oversupplied as between 1 and 2 million barrels of crude are being pumped out of the ground every day in excess of demand, leaving storage tanks around the world filled to the brim with unsold fuel.

So as has been the case for Oil recently the longer term outlook remains unclear as the market continues to digest the persistent oversupply with the decrease in production from U.S. producers and the increase of oil imports to China and the increase in gasoline consumption in the U.S. Overall Consensus: Neutral to Slightly Bullish

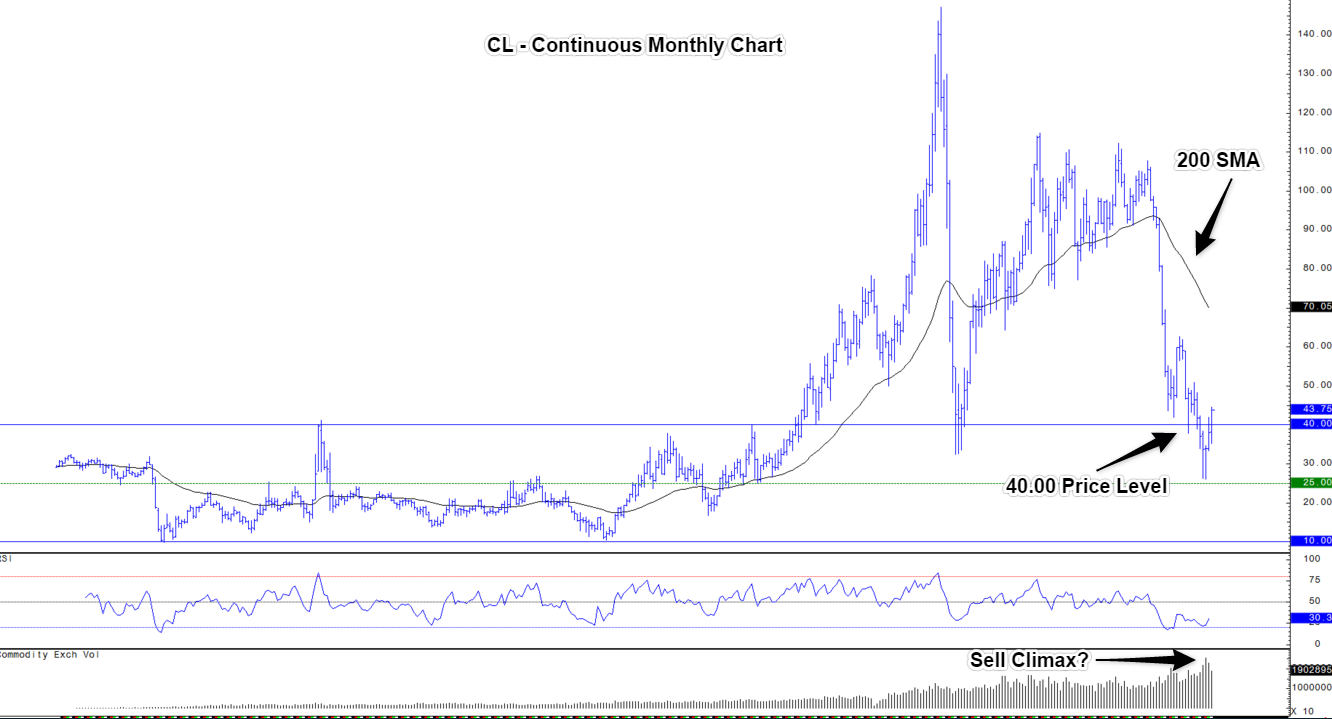

Monthly Chart

CL continues to trade well below the all-important 200 SMA. Having said that, we are up significantly off of the February lows. In addition to the recent rally, it appears as though we may have had a “climax” on the sell off with the increased volume and the oversold readings on the RSI. The fact still remains that as long as we continue to hold market structure below the 200 SMA the big picture is bearish. Overall Consensus: Bearish

Price is testing the 200 SMA and will be the tell to the near term direction of crude. We are beginning to show overbought readings on the Stochastics. Overall Consensus: Neutral Transition

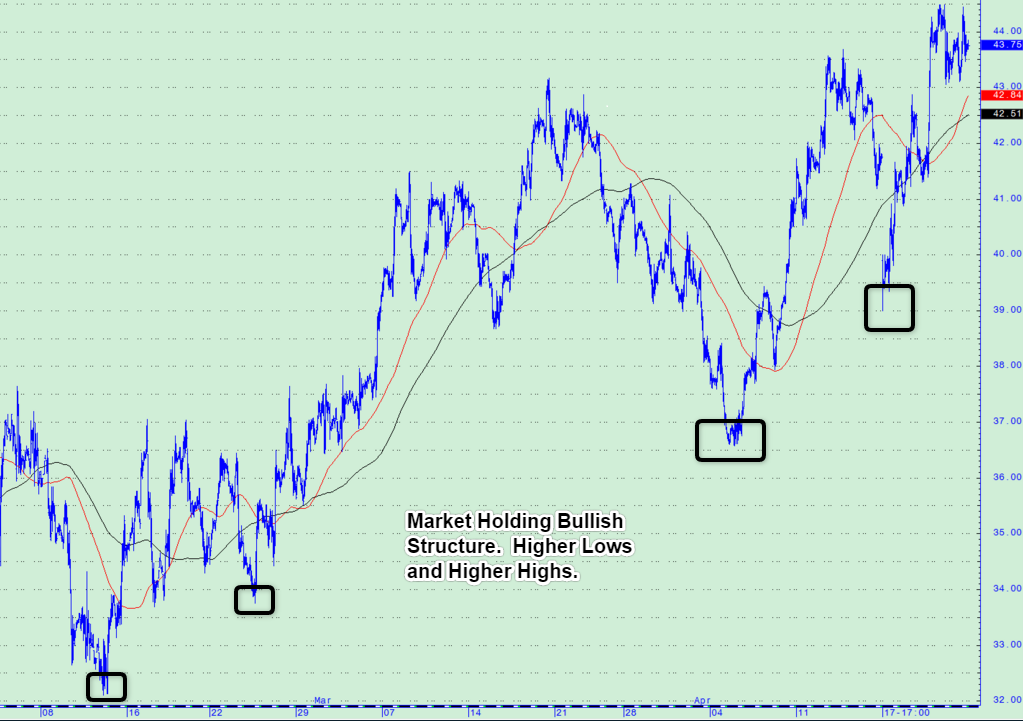

60-Minute Chart

The near term structure has definitely shifted to bullish. We are in a classic bull pattern, higher lows and higher highs. As is always the case, the smaller time frames will make the transition between market states, more quickly. Additionally, we are trading above both the 100 and 200 SMA’s. This is a good indication that the Overall Consensus is: Bullish

Weekly Price Targets

46.34 – 46.81

47.77 – 48.24

49.19 – 50.60

Below the Market

40.63 – 40.15

39.20 – 38.72

37.77 – 36.37

For Free Trial Access to the Oil Trading Group Trading Room, CLICK HERE