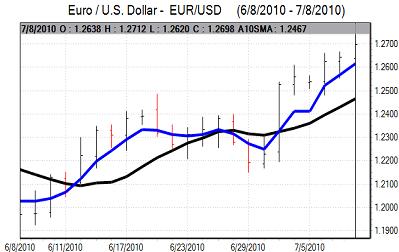

EUR/USD

The Euro held firm in early Europe on Thursday with firm stock market trends again curbing any defensive demand for the US dollar. There was a mixed report from the IMF as it was more optimistic over the global outlook, but also warned over potential downside risks. There were concerns over the US outlook which also curbed dollar demand to some extent, especially with the IMF warning over the potential impact of a strong dollar.

As expected, the ECB held interest rates at 1.0% following the latest council meeting. Bank President Trichet adopted a generally optimistic tone in his press conference with comments that the economy was gaining momentum while he also stated that markets had been over-pessimistic towards the economy and stresses within bond markets.

The US jobless claims was slightly better than expected with a decline to 454,000 in the latest week from a revised 475,000 previously which may lessen fears surrounding the labour market to some extent. There has also been some optimism over the latest consumer spending trends, although confidence will remain fragile given the recent run of data.

Regional Fed President Hoenig maintained his view that interest rates should be raised to 1.0% in a move towards normality, but markets will not be expecting majority support for a decision to raise rates.

The Euro pushed to a two-month high against the dollar close to 1.27 and after a bout of profit taking pushed stronger again late in the New York session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Australian employment data was stronger than expected on Thursday which maintained global interest in carry trades and undermined defensive demand for the Japanese currency.

In contrast, the domestic data was weaker than expected with core machinery orders dropping 9.1% for May. There was also a 2.1% decline for bank lending in the year to June, the 7th successive decline, and the data will maintain expectations that the Japanese economy is facing further stresses. In this context, there will also be expectations that the Finance Ministry will oppose yen appreciation. With risk appetite firmer, the yen weakened to lows around 88.30 against the US currency.

The dollar was able to maintain a firmer tone following the US jobless claims data, but there was resistance close to 88.60 and the US currency drifted back to the 88.30 area.

Sterling

The UK currency again tested resistance levels above 1.52 against the dollar in early Europe on Thursday with a significant advance against the yen on risk considerations.

The currency was unsettled slightly by a weaker than expected Halifax house-price report. The mortgage lender reported a 0.6% decline in prices for June after a revised 0.5% drop the previous month, reinforcing unease over the housing market.

The Bank of England held interest rates at 0.5% following the latest MPC meeting which was in line with market expectations. The amount of quantitative easing was also on hold and there was no statement following the meeting. The breakdown of the vote will not, therefore, be known until the minutes are released in two weeks time.

The latest NIESR economic report estimated GDP growth of 0.7% for the second quarter which will provide some degree of support for growth expectations and should also curb selling pressure on Sterling.

There was further resistance above 1.52 against the dollar with a retreat towards 1.51 where support emerged. Sterling also found support close to 0.8380 against the Euro.

Swiss franc

The dollar found support close to 1.0480 against the franc on Thursday, but there was resistance close to 1.0560 with the dollar unable to make much headway. The Euro was trapped close to the 1.33 region against the franc.

The Swiss unemployment data recorded a slight decline to 3.9% for June from 4.0% previously which will maintain some optimism towards the economy.

There will still be defensive support for the Swiss currency which will curb any underlying selling pressure on the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

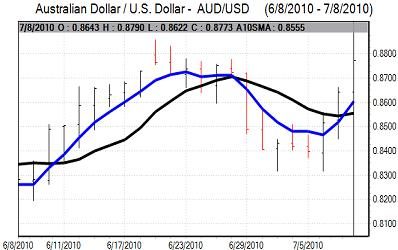

Australian dollar

The latest employment data was stronger than expected with an employment increase of over 45,000 for June which boosted confidence in the domestic economy. The Australian dollar pushed to a high around 0.8760 against the US dollar as international risk appetite also improved. There are still very important domestic and international risks which could undermine interest in the local currency, especially with freight rates still declining.

The Australian currency edged weaker in New York trading with evidence of profit taking after a very strong advance over the previous 36 hours, but there was support close to the 0.87 level.