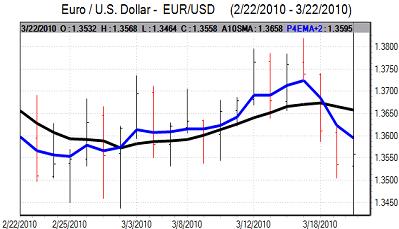

EUR/USD

Over the weekend, German Chancellor Merkel stated that markets should not expect a EU deal on Greek support which reinforced a lack of confidence in the Euro as fiscal speculation surrounding the region continued unabated.

Option-related bids still providing some degree of Euro support close to 1.35 in early Europe on Monday, but the currency came under renewed pressure during the session and dipped to 3-week lows just above 1.3460.

There were a stream of conflicting comments surrounding Greece and uncertainty remained a key feature ahead of the EU summit which is due to be held on March 25-26th. ECB President Trichet stated that Greece had made a courageous decision which helped underpin sentiment to some extent. There was further solid bidding interest below the 1.35 level and the currency recovered to around 1.3550 late in the European session.

It will still be very difficult to secure a sustained improvement in confidence as contradictory rhetoric will persist.

There were no significant US economic data releases on Monday and, although the housing-related data could have a significant short-term impact on Tuesday, the data may not provide longer-term direction. Markets will still be looking to take a generally positive attitude towards US growth which should provide background dollar support as longer-term yield spreads remain more favourable.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar/yen ranges were still relatively narrow during Asian trading on Monday with activity dampened by a market holiday in Tokyo. There is still the potential for some capital repatriation ahead of the fiscal year-end which will tend to protect the yen over the next few days.

In this context, the dollar dipped to lows close to 89.80 later on Monday while the Euro also declined to lows near 121 against the Japanese currency.

There was dollar buying support at lower levels with a move back to 90.15 later in the US session while the Euro also recovered from lows. A recovery in risk appetite curbed immediate demand for the yen and narrow ranges may prevail in the short term given conflicting pressures.

Sterling

There was an initial Sterling decline towards 1.4920 against the dollar on Monday as confidence towards the economy and currency remained very fragile. There were also renewed doubts over the banking sector which unsettled the currency.

The stock market rallied firmly from intra-day lows which helped support Sterling, especially as international risk appetite also stabilised.

Bank of England Governor King was generally cautious over the economy in comments on Monday which will tend to dampen sentiment. The inflation data will be watched closely on Tuesday and a higher than expected figure could trigger additional Sterling volatility as any initial gains may not be sustained.

The government-debt position will also inevitably remain a key focus ahead of Wednesdays budget. Underlying confidence will remain extremely fragile, but further selling pressure may be contained at this time. Sterling was able to rally back to highs around 1.51 against the dollar as the US currency came under pressure while the Euro also lost ground after being blocked close to 0.9045.

Swiss franc

The dollar found support close to 1.0560 against the franc in early Europe on Monday and strengthened to highs around 1.0660 in early US trading. The US currency was unable to sustain the gains and weakened back to 1.0580 later in the session.

The Swiss currency continued to draw strong support on the crosses and strengthened to highs near 1.4310 against the Euro before a limited retreat.

Comments from National Bank officials will remain under close scrutiny with bank President Hildebrand due to speak on Tuesday and volatility levels are liable to remain higher in the short term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

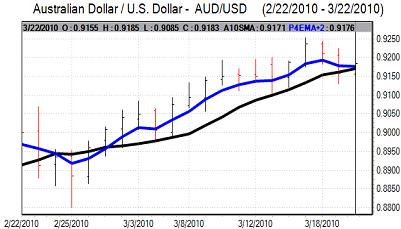

Australian dollar

The Australiandollar dipped further to lows near 0.9080 against the US dollar on Monday as investors remained generally more cautious towards risk assets.

The mood was significantly more optimistic later in the US session and there was a firm rally back to highs near 0.9175 later in New York. Volatility levels are liable to remain higher in the near term, especially with policy uncertainty still surrounding China.