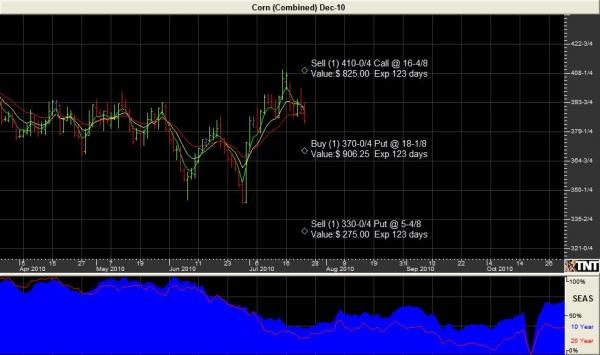

7-26-10 December Corn is heading into a seasonally weaker time period and the charts are showing signs of a change in direction suggesting the market is heading lower. We are buying the December 370/330 bear put spread and selling the 410 call as a naked leg. The spread will cost you $125 not including transaction costs, which would be the risk with the market under 410, above 410 the risk is unlimited. The profit potential is limited to $2000 minus costs.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

There is a substantial risk of loss in trading futures and options.

PLACING CONTINGENT ORDERS SUCH AS “STOP LOSS” OR “STOP LIMIT” ORDERS WILL NOT NECESSARILY LIMIT YOUR LOSSES TO THE INTENDED AMOUNTS. SINCE MARKET CONDITIONS MAY MAKE IT IMPOSSIBLE TO EXECUTE SUCH ORDERS.

Past performance is not indicative of future results.

The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities.. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction.

FOR CUSTOMERS TRADING OPTIONS, THESE FUTURES CHARTS ARE

PRESENTED FOR INFORMATIONAL PURPOSES ONLY. THEY ARE

INTENDED TO SHOW HOW INVESTING IN OPTIONS CAN DEPEND ON

THE UNDERLYING FUTURES PRICES; SPECIFICALLY, WHETHER OR NOT

AN OPTION PURCHASER IS BUYING AN IN-THE-MONEY, AT-THE-MONEY,

OR OUT-OF-THE-MONEY OPTION. FURTHERMORE, THE PURCHASER

WILL BE ABLE TO DETERMINE WHETHER OR NOT TO EXERCISE HIS

RIGHT ON AN OPTION DEPENDING ON HOW THE OPTION’S STRIKE

PRICE COMPARES TO THE UNDERLYING FUTURE’S PRICE. THE FUTURES CHARTS ARE NOT INTENDED TO IMPLY THAT OPTION PRICES

MOVE IN TANDEM WITH FUTURES PRICES. IN FACT, OPTION PRICES MAY ONLY MOVE A FRACTION OF THE PRICE MOVE IN THE UNDERLYING

FUTURES. IN SOME CASES, THE OPTION MAY NOT MOVE AT ALL OR

EVEN MOVE IN THE OPPOSITE DIRECTION OF THE UNDERLYING FUTURES CONTRACT.

Paul Brittain

Whitehall Investment Management

Commodity Trading School

877-270-8403

info@commoditytradingschool.com

paul@binvstgrp.com