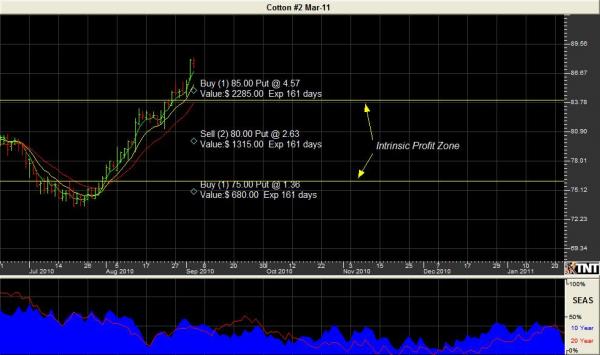

Cotton has been on a tear to the upside due to lower plantings as well as the worries associated with Hurricane Earl, which looking back did no real damage, however other than that this market seems to be suffering from “irrational exuberance” and much of the move is just speculative. Believing in the age old theory of what goes up must come down we are starting to establish bearish option strategies in hopes of being their when it does. Due to the nature of this market we are limiting or strategies to “limited risk” only trades. We like the March Iron Butterfly using puts; buy the March 85 put; sell two March 80 puts and buy one 75 put. The spread is running at $450 before adding in the commissions on the FOUR legs in this trade which is also the risk of the trade (premium plus commission). The profit potential based upon intrinsic value can be as much as $2500 with the market at 80 (before deducting costs) on expiration, but would be profitable anywhere between the break-even levels. This trade has limited risk, no margin requirement as well as limited profit potential. Good Luck

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

There is a substantial risk of loss in trading futures and options.

PLACING CONTINGENT ORDERS SUCH AS “STOP LOSS” OR “STOP LIMIT” ORDERS WILL NOT NECESSARILY LIMIT YOUR LOSSES TO THE INTENDED AMOUNTS. SINCE MARKET CONDITIONS MAY MAKE IT IMPOSSIBLE TO EXECUTE SUCH ORDERS.

The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities.. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction.

FOR CUSTOMERS TRADING OPTIONS, THESE FUTURES CHARTS ARE PRESENTED FOR INFORMATIONAL PURPOSES ONLY. THEY ARE INTENDED TO SHOW HOW INVESTING IN OPTIONS CAN DEPEND ON THE UNDERLYING FUTURES PRICES; SPECIFICALLY, WHETHER OR NOT AN OPTION PURCHASER IS BUYING AN IN-THE-MONEY, AT-THE-MONEY, OR OUT-OF-THE-MONEY OPTION. FURTHERMORE, THE PURCHASER WILL BE ABLE TO DETERMINE WHETHER OR NOT TO EXERCISE HIS RIGHT ON AN OPTION DEPENDING ON HOW THE OPTION’S STRIKE PRICE COMPARES TO THE UNDERLYING FUTURE’S PRICE. THE FUTURES CHARTS ARE NOT INTENDED TO IMPLY THAT OPTION PRICES MOVE IN TANDEM WITH FUTURES PRICES. IN FACT, OPTION PRICES MAY ONLY MOVE A FRACTION OF THE PRICE MOVE IN THE UNDERLYING FUTURES. IN SOME CASES, THE OPTION MAY NOT MOVE AT ALL OR EVEN MOVE IN THE OPPOSITE DIRECTION OF THE UNDERLYING FUTURES CONTRACT.