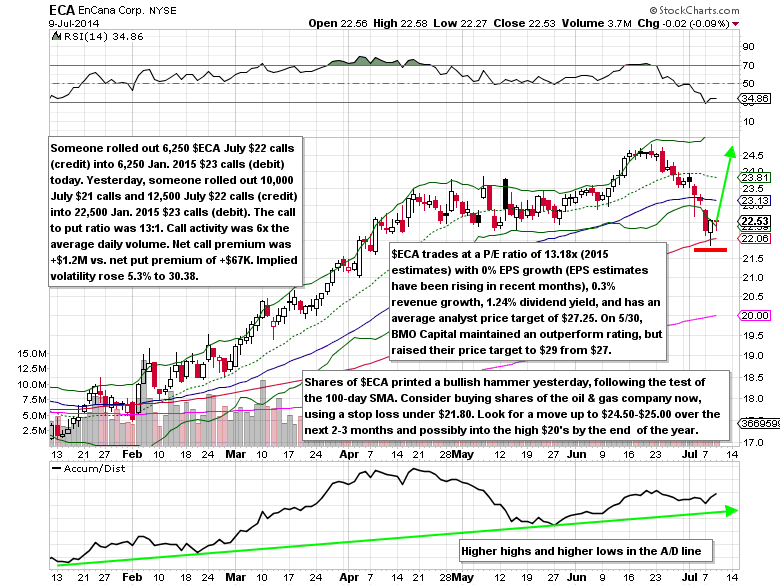

Shares of the oil and gas producer, Encana (ECA), are up 25.66% year to date compared to the Energy Select Sector SPDR ETF’s (XLE) 14.20% gain. Despite the outperformance against the bulk of its peers, Encana trades at a P/E ratio of 13.18x (2015 estimates), 0.3% revenue growth (17.8% revenue growth this year), 1.24% dividend yield, and has an average analyst price target of $27.25. Just three months ago 2014 EPS estimates were $1.09 and 2015 EPS estimates were $1.18. Since then 2014 estimates have rose 57% to $1.71 and 2015 estimates have rose 45% to $1.71. M&A has been a big part of the story for Encana this year with the recent sale of their Bighorn Properties for $1.9B to Apollo Global Management. Prior to this deal Encana bought Eagle Ford shale assets for $3.1B from Freeport-McMoRan Copper & Gold (FCX).

Unusual Options Activity

On Wednesday, July 9, someone rolled out 6,250 July $22 calls (credit) into 6,250 Jan 2015 $23 calls (debit). The call to put ratio was 13:1. Call activity was over 5 times the average daily volume. Net call premium was +$1.2M vs. net put premium of +$67,000. Implied volatility rose 5.3% to 30.38. The day before this activity someone rolled out 10,000 July $21 calls and 12,500 July $22 calls (credit) into 22,500 Jan 2015 $23 calls (debit). The breakeven from the big buyer of Jan 2015 $23 calls has a breakeven of $24.50-$24.60. Back in February there was large buying in the July $19-$22 calls (the calls that were sold this week) when the stock was around $18.

Encana Options Trade Idea

Buy the Jan 2015 $23 call for $1.65 or better

Stop loss- None

First upside target- $3.30

Second upside target- $5.00

Disclosure: I’m long the Jan 2015 $23 calls for $1.62 each.

= = =

Check out Mitchell’s Free Trade of the Day featuring Linear Technology (LLTC).