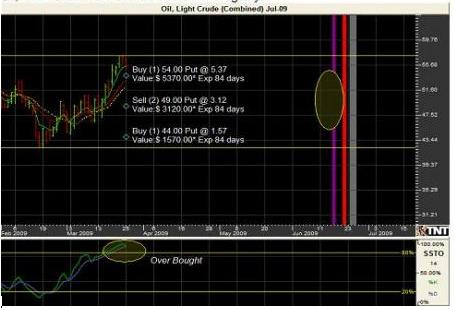

July Crude Oil is trading neat the top of its range and unless there is some kind of drastic shift is supply or demand we should see the market drift back towards the bottom of its range over the next 60-90 days. We like the Put Fly which gives us limited risk as well as no margin requirement (10K). The spread is running 5-700 dollars which is your risk with the market trading above or below the spread, if we get the market at the mid-point near expiration we could make as much as $5000. Remember that we need time to go by.

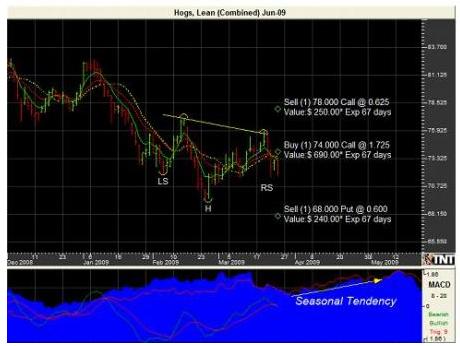

June Lean Hogs are forming a head and shoulders bottom and we could and should see the market go higher if this formation holds. The industry is also looking for a tightening supply picture in the next few months. Buy the June 74/78 bull cal spread and sell the June 68 as the naked leg. The risk on the trade is the premium paid $(150) with the market above 68. Under 68 the risk is unlimited. The profit potential is $1600 before cost considerations.