The markets are in what’s known as the “just around the corner” trade. This is a scenario where the perceived risk of downside is not in the near term, but a month or two off– in other words, “just around the corner.”

This has left front month options with very little implied volatility relative to other months–and it is a tradable opportunity if you have the margin available.

Let’s look at Nike (NKE) as an example. After a disastrous earnings report, the stock has been gaining ground and is coming to a critical time in its technicals. See Figure 1 below.

VOLATILITY COMPRESSION

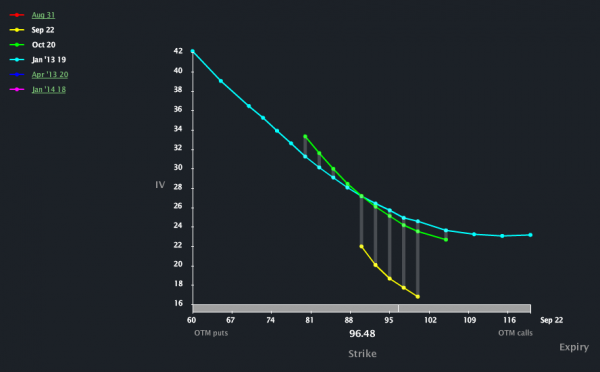

The stock continues to make lower highs and higher lows, with an indication of volatility compression. A break in either direction is in the cards very soon. The next piece of evidence for the NKE trade is a look at the volatility skew charts, courtesy of LiveVol, seen in Figure 2.

The yellow line is the implied volatility for September options. Relative to the next two months, it is at a very, very low level.

The yellow line is the implied volatility for September options. Relative to the next two months, it is at a very, very low level.

STRUCTURE THE TRADE

You can use options to structure a trade that looks for a few things to happen:

1. A fast move in either direction

2. Front month volatility to go higher

3. Back month volatility to go lower

4. The term structure to shift back to the mean

THE TRADE

Here is the trade to consider:

Buy 1 NKE Sep 97.5 Call for 1.20

Sell -1 NKE Oct 100 Call for 1.90

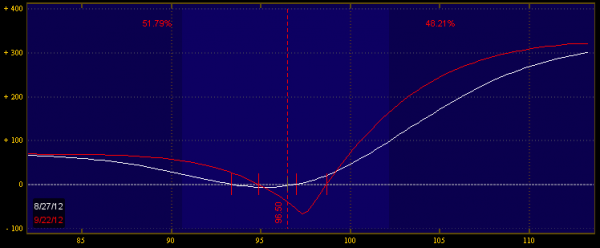

While the overall risk of this trade is capped, it does require margin as the back month option is the one that is sold. Let’s examine the risk dynamics of this trade, seen in Figure 3.

TAKING PROFITS

The trade is profitable if, within the next month, NKE has a strong move either below 95 or above 97.5. The reward is skewed to the upside as the near term trend has been higher.

There are two main risks to this trade. First, if NKE makes no fast move anytime soon, the trade loses money due to the theta loss in the position. Second, if the implied volatility structure continues to widen (very unlikely) then the trade will have “headwinds” and will require a larger magnitude move to be profitable.