Shares of Oneok (OKE) have had a great 2013, rising 32.79% year to date.

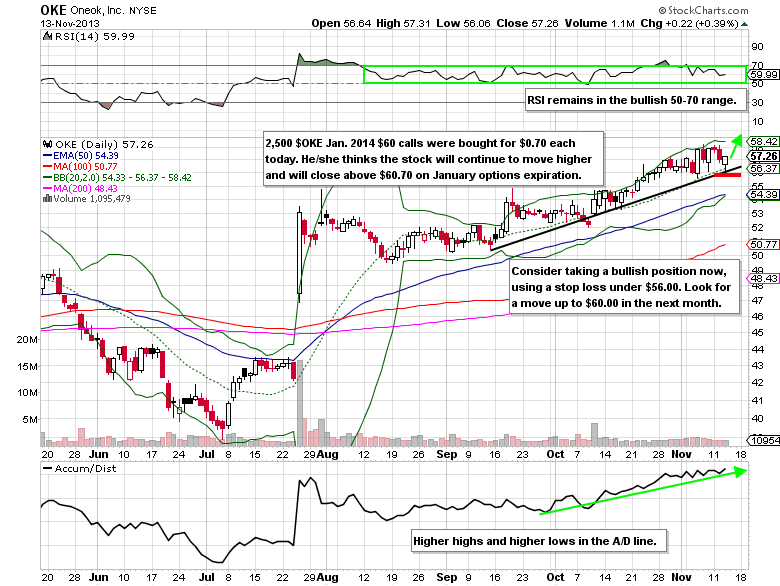

Despite the run it has had, someone bought 2,500 Jan 2014 $60 calls for $0.70 each on Wednesday, November 13th. This is $175,000 worth of call premium.

He/she thinks the natural gas utility company will close above $60.70 on January 2014 options expiration. Call to put ratio in Oneok options was overwhelming in favor of the bulls at 26.06 (4,743 calls vs. 182 puts traded).

THE TECHNICAL TAKE

Since September, Oneok shares have found buyers on pullbacks to the middle Bollinger Band (20-day simple moving average). Following the bullish order flow in the options market highlighted above, this stock once again found support and printed a bullish hammer pattern by the closing bell on Wednesday. As long as Oneok continues bounce off of the middle Bollinger Band, this is a name you want to stay bullish on.

OPTION TRADE IDEA

Buy: the Jan 2014 $60 Call for $1.00

Stop loss: $0.45

Upside target: $2.00-$2.50

= = =

Check out Warren’s Free Trade of the Day featuring Mylan Laboratories (MYL)

Join the conversation on our Facebook page. We’d love to hear from you.