Shares of the coal company, Peabody Energy (BTU), are down over 31% year to date. Peabody Energy trades at a forward PEG ratio of 0.33 and is expected to grow EPS next year by 83.30%. The median Wall Street analyst price target is $24, which is more than 31% above the current share price. Generating positive free cash flow isn’t a problem either compared to competitors such as Walter Energy (WLT) who hasn’t done so in the last year. Peabody Energy also offers better yield protection than Walter Energy (1.86% vs. 0.27%).

TECHNICAL TAKE

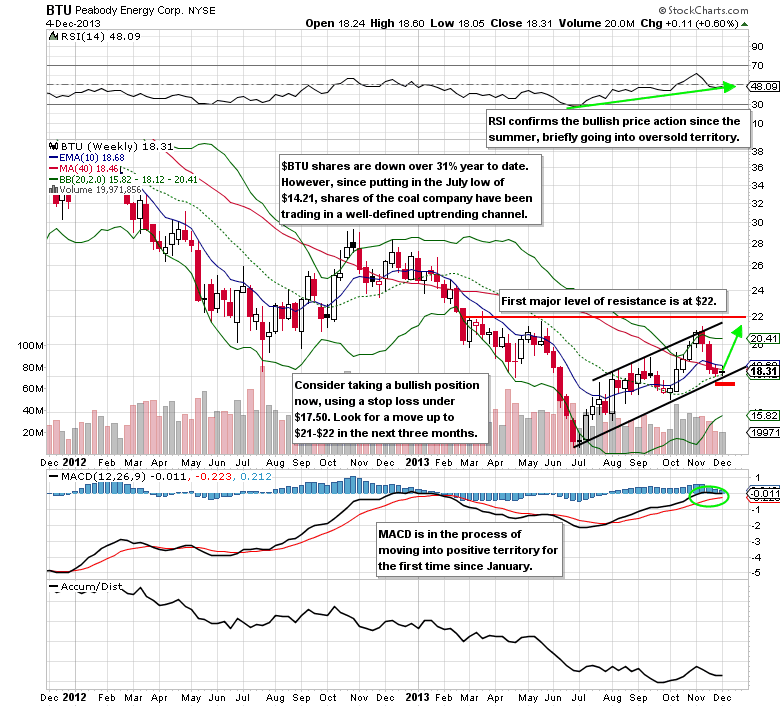

Since bottoming out in July at $14.21, the stock has been trading in a well-defined uptrending channel. Over the course of the last two weeks Peabody Energy shares have been testing the bottom of the channel and are now starting to move higher. There are clear skies to the $22 resistance level, which offers nearly $4 of upside potential in the intermediate term. To effectively manage risk a stop loss can be placed under $17.50, bringing the reward/risk ratio to 4.50. In recent weeks, options traders have also been buying upside calls in the January 2014 options expecting a move into the low $20’s.

OPTIONS TRADE IDEA

Buy the Jan 2014 $18 call for $1.15 or better

Stop loss- None

Upside target- $3.00-$4.00

= = =

See Warren’s Free Trade of the Day featuring Starbucks (SBUX)

Join the conversation on our Facebook page. We’d love to hear from you.