EUR/USD

The Euro was above 1.41 in early Europe on Friday as the currency looked to rebound from over-sold conditions following sharp selling during the week.

Underlying confidence towards the Euro-zone remained weak, butt here was no further bad news during the day. The latest industrial orders data was also stronger than expected which provided some degree of support.

Risk appetite remained generally weaker, but the dollar again found it more difficult to gain support following Obama’s Thursday announcement of plans to increase regulation in the banking sector.

The position of Fed Chairman Bernanke was also a significant factor during the day as the Senate failed to hold a vote on his confirmation for a second term. There was some speculation that the Senate leadership were not confident of getting sufficient votes for a confirmation and this hampered the dollar to some extent.

With his term officially expiring at the end of January, any further delays could undermine the dollar next week, especially with the latest Federal Reserve interest rate decision due on Wednesday and the US currency would also be likely to spike lower if his nomination is rejected.

The Euro found support below the 1.41 level during Friday and was able to consolidate above the 1.41 level as dollar momentum faded at least in the short term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar tested support levels below the 90 level against the yen during Asian trading on Friday as equity markets remained under pressure. There was also some evidence of capital flows into Japanese equities which provided support to the yen.

There will be pressure on the Finance Ministry and Bank of Japan to curb yen strength and comments from top officials will be watched very closely in the near term. Given some speculation over intervention, the dollar edged back above the 90 level.

The dollar continued to find some support below the 90 level over the remainder of Friday while the yen lost some ground on the crosses.

Sterling

The December UK retail sales data was weaker than expected with a 0.3% monthly increase compared with expectations of an increase above 1.0% which pushed Sterling weaker, especially as the corporate reports had suggested a firmer sector.

Overall confidence in the economy will remain very fragile given the underlying vulnerabilities, especially with political stresses still having potentially very important implications for the deficit trend.

The banking-sector proposals will also be monitored closely as any evidence that the UK sector could be tightened more aggressively than in other countries would increase speculation over capital outflows and could be a negative factor for the currency.

Sterling weakened to a 10-day low against the dollar, but found support below the 1.61 level. The Euro strengthened to a high of 0.8770 against the UK currency.

Swiss franc

The dollar was unable to make a further attack on the 1.05 region during Friday, but did find some support below the 1.04 level.

National Bank Chairman Hildebrand stated that the central bank would resolutely prevent excessive franc gains. The tough rhetoric from the bank head will increase speculation that the bank will intervene aggressively and the Euro was able to push back above the 1.47 level against the franc.

The Swiss currency will still tend to gain some defensive support on fears over the Euro-zone economy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

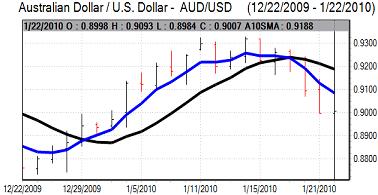

Australian dollar

The Australian dollar tested levels below the 0.90 level against the US dollar in local trading on Friday. The US dollar was still generally firmer while risk appetite was also weaker as equity prices were subjected to further selling pressure.

Confidence is likely to remain weaker in the short term, but selling pressure eased during the day and the Australian dollar was able to consolidate around the 0.9050 level later in the US session.