Shares of Owens Corning (OC), a $4B Ohio based construction supplies and fixtures company, are down nearly 15% year to date. However, there are now factors developing that may prove to make Owens Corning an attractive investment.

First is the valuation of the company when looking out to next year. The stock trades at a P/E ratio of 14.75x (2015 estimates) with 37.3% EPS growth, price to sales ratio of 0.75x, and a price to book ratio of 1.03x. Revenue growth is expected to accelerate from 0.6% to 6.1% in 2015. They have a decent dividend, which is currently yielding 1.87%. On October 22, Owens Corning reported Q3 EPS of $0.63 vs the $0.50 estimate ($0.53 in the Q3 2013) and revenue of $1.38B vs the $1.39B estimate (4.7% increase on a year-over-year basis). These solid numbers are likely why the average analyst price target of the 16 brokers who cover the stock is $41.77 (more than $7 of upside if proven right).

Another bullish sign is the large call buying on November 12th. Call activity was 30 times the average daily volume as roughly 10,000 calls traded. The call to put ratio of 17:1 was mainly due to buying in the Jan 2015 $37 calls for $0.35-$0.45. This hedge fund or large institution sees more than $3 of upside over the next two months of trading, given that their breakeven point is $37.35-$37.45. The massive amount of calls traded sent implied volatility up 6.9% to 25.44 on the day.

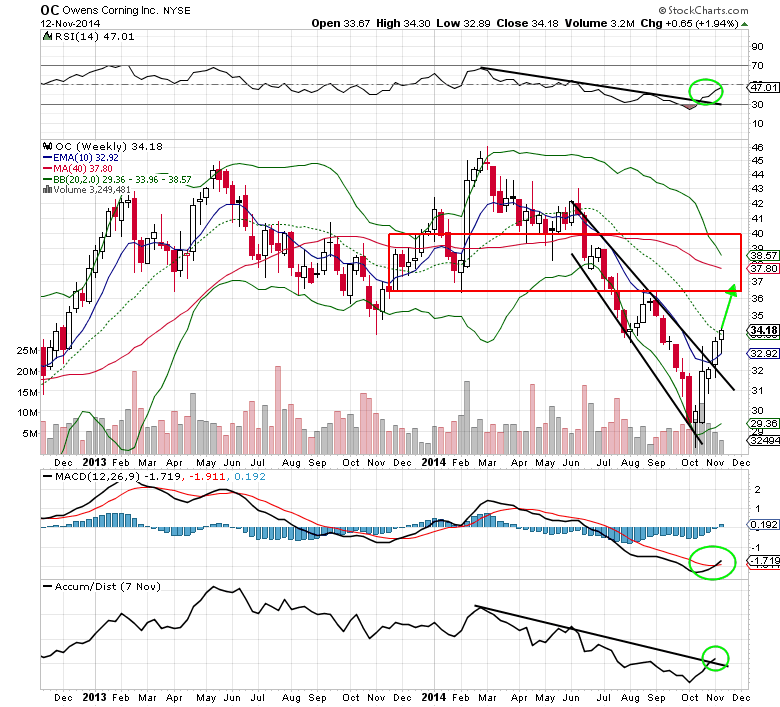

Finally, the two year weekly chart shows that Owens Corning shares are starting to break out above the multi-month resistance level at the 10-week exponential moving average. MACD (moving average convergence divergence) is now in the middle of a bullish crossover for the first time since April. Also, the other two secondary indicators, the RSI and the accumulation/distribution line, are confirming the breakout with recent bullish moves of their own. Upside from current levels is $2-$6 before major resistance levels come into play, meaning the large call buyers might be sitting on sizable profits come January.

Owens Corning Options Trade Idea

Buy the Jan 2015 $34/$38 bull call spread for a $1.30 debit or better.

(Buy the Jan 2015 $34 call and sell the Jan 2015 $38 call, all in one trade)

- Stop loss- None

- 1st upside target- $2.60

- 2nd upside target- $3.9

#####

For more information on unusual options, click here.