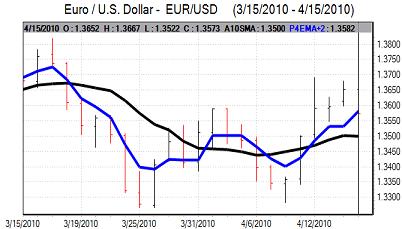

EUR/USD

The dollar remained generally slightly weaker in early Europe on Thursday, but the Euro was unable to extend gains seen in the previous session.

The pattern of fluctuating sentiment towards the Euro persisted with markets less confident during the day. There was a fresh widening of yield spreads during the day with Greek bonds moving back to yield more than 400 basis points over German bunds. There was renewed speculation that the support package would not be able to mask the underlying stresses with the weaker member countries trapped in an environment of weak growth. The Euro dipped sharply to lows near 1.3520 with some reports of central bank selling of the currency.

The US economic data was mixed during day with a slightly firmer bias. The business survey evidence was robust with the New York manufacturing index rising to 31.9 for April from 22.9 the previous month while the Philadelphia Fed index also strengthened to 20.2 from 18.9 and this was the highest level since December 2009 which will maintain optimism towards the manufacturing sector.

In contrast, the jobless claims data was weaker than expected with a further increase in initial claims to 484,000 from 460,000 the previous week. Seasonal factors may again have played a part, but the second successive week of higher claims could raise some fresh doubts over employment trends.

The dollar struggled to extend the advantage and the Euro recovered back to around 1.3570 later in the US session. The dollar will need evidence of a Fed policy shift to draw further support on yield grounds.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk appetite remained firm on Thursday with confidence boosted by robust Chinese GDP data which, in turn, also maintained optimism over the regional and global economies. With risk appetite firm, there were expectations of further carry-related outflows from Japan. The Euro pushed higher against the yen for the sixth successive day before hitting profit taking.

There will be further strong speculation over a Chinese currency revaluation within the next few days and this should provide some degree of yen protection. The dollar initially held around 93.25 as demand for both currencies was generally weaker and the dollar held just above 93.

The yen regained some ground on the crosses as a slightly more cautious attitude towards risk curbed selling pressure on the Japanese currency.

Sterling

Sterling retreated to test support levels below 1.54 against the dollar in European trading on Thursday, but found support at lower levels and recovered back to the 1.55 area later in New York. The UK currency gained support against the Euro which also provided support for Sterling.

There was an opinion poll which suggested the vote distribution in the forthcoming election would increase the chances of a decisive outcome and this provided some support. Opinion polls will continue to be monitored closely in the near term and any further evidence of a decisive outcome would provide some degree of support for Sterling.

The global attitude towards risk and credit ratings will continue to have an important impact on Sterling sentiment. The UK currency will be much more vulnerable to selling pressure when confidence deteriorates.

Swiss franc

The dollar again found support close to 1.05 against the franc on Thursday and re-tested resistance levels just above 1.06 before consolidating below 1.0580. The Euro was again unable to make any headway against the Swiss currency and settled just above the 1.4320 level.

Euro support was again sapped by the underlying lack of confidence in the Euro-zone economy.

National Bank member Jordan did not mention the franc’s level in comments on Thursday and there will be further uncertainty over the bank’s policies as pressure for intervention will persist.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

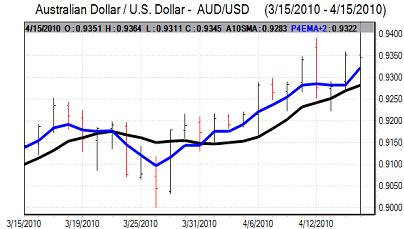

Australian dollar

Optimism towards the local and regional economy remained intact and there was a peak close to the 0.9360 level against the dollar on Thursday, but the currency was then subjected to a slightly weaker trend.

The Australian dollar was unsettled by a measured deterioration in risk appetite during the day. There were also fears over the risk of a Chinese revaluation or a move to raise interest rates which would tend to tighten policy and also put some downward pressure on commodity prices which would tend to undermine the Australian currency.