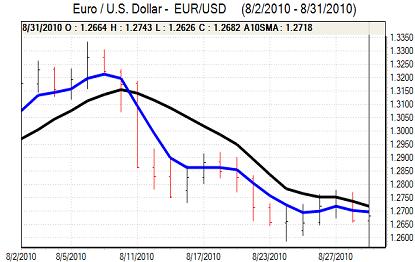

EUR/USD

The Euro found support below 1.2650 against the dollar during Tuesday and rallied to highs just below 1.2750 during the US session. The Euro was unable to sustain the advance and re-tested support levels near 1.2650 during Wednesday.

The Euro-zone data was broadly in line with expectations and did not have a major impact. There will be persistent concerns over structural vulnerabilities and Chinese Premier Wen called for confidence in the Euro to be enhanced which suggests that China will tend to be cautious over buying Euro assets in the near term.

The US economic data was mixed and did not have a decisive impact, but there was still an underlying mood of unease over prospective developments. Consumer confidence rose to 53.5 for August from a revised 51.0 the previous month with the index still at depressed levels historically as labour-market fears persisted.

The Chicago PMI index fell to 56.7 from 62.3 the previous month which maintained expectations that the economy is losing momentum. The Fed minutes from August’s meeting recorded that some members were uneasy over the changes to the asset-purchases scheme and there is certainly the risk of greater divisions within the Fed over the next few months which will maintain the threat of volatility. Despite important reservations, the Euro again found support above 1.2650 on Wednesday as risk appetite attempted to stabilise.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained under pressure during Tuesday and tested support below 84 against the yen. There were further concerns over a slowdown in the global economy which maintained defensive demand for the Japanese currency.

The US data and a late rally on Wall Street eased immediate fears to some extent and the dollar resisted further selling pressure. There were also reports of central bank buying support below the 84 level which curbed yen demand.

The latest Chinese PMI data, together with stronger than expected Australian data had a positive impact on risk conditions which lessened upward pressure on the yen during Wednesday. In this environment, the US currency rallied to the 84.50 area.

Sterling

Sterling came under further pressure against the dollar during Tuesday with a five-week low below 1.5350 during US trading and there were further tests of support towards 1.5320 in Asian trading on Wednesday. Technical considerations played a role with Sterling dipping underneath the 200-day moving average which triggered some increase in selling pressure.

The consumer lending and mortgage approvals data was slightly weaker than expected and there are considerable fears that the economy will stall during the next few months.

There will also be persistent fears over an underlying credit crunch which could have a serious negative impact on the economy during the next few months.

The UK currency did find some respite after a stabilisation in risk appetite and it rallied back to the 1.54 region in Asian trading on Wednesday while the Euro rally stalled close to 0.8280. The latest PMI data will be watched closely on Wednesday.

Swiss franc

The Swiss franc maintained a very firm tone on Tuesday and advanced to fresh record highs near 1.2850 against the Euro. The dollar also retreated to lows below 1.0150 before finding some support while the Euro was able to regain the 1.29 level.

There was further defensive demand for the Swiss currency as underlying confidence in the global economy remained weak. There were also some fears over a renewed deterioration in credit conditions which underpinned the franc.

Domestically, there was a solid reading for the UBS consumption index which boosted confidence in the economy and lessened immediate fears over a return of deflationary pressures which would also lessen the case for currency intervention.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

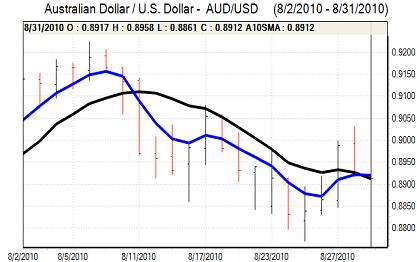

Australian dollar

The Australian dollar tested support levels below 0.89 against the US dollar during Wednesday as risk appetite remained generally weak. There was some recovery late in US trading as equity markets attempted to rally. The Australian currency also gained support from firmer than expected readings for the China PMI indices.

Domestically, there was a disappointing reading for the PMI manufacturing index as it fell to 51.7 from 54.4 the previous month, but the GDP data was stronger than expected with a 1.2% second-quarter advance which pushed the Australian dollar to near the 0.90 level. Despite an immediate boost to confidence, underlying doubts over the economy are liable to increase.