EUR/USD

Risk appetite remained weaker in European trading on Monday while potential delays to any IMF talks on Greece due to travel disruption also unsettled investors. The Euro retreated to the 1.3450 support region as equity markets remained under some selling pressure.

There were persistent doubts surrounding the Euro-zone during the day, especially with fears that pressures could spread to the more important Portuguese market which would also risk a serious escalation in medium-term doubts surrounding the Euro. There were also cautious remarks surrounding Euro-zone debt from Chinese officials which unsettled sentiment.

There were reports of option-related Euro buying close to the 1.3420 level which helped stem selling pressure and there was also a cautious recovery in risk appetite during the day as Goldman Sachs shares were also able to recover from initial losses.

There were no significant US economic data releases during the day which stifled trading activity to some extent. The US currency is tending to gain some support from expectations over a solid US economic rebound. This backing is still being limited by generally cautious remarks from Fed officials with Governor Duke repeating concerns over the commercial real-estate market. In this context, the Euro was able to rebound to the 1.3485 area later on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen maintained a firm tone on Monday as risk appetite remained weaker with the currency making further headway on the crosses. The latest speculative positioning data recorded an increase in yen short positions to a three-year high and this will maintain the potential for a further squeeze on short positions which should curb selling pressure on the Japanese currency.

As risk conditions stabilised later in US trading, yen demand also faded to some extent. From lows near 91.60 against the yen, the dollar recovered to 92.40 while the Japanese currency also retreated from its best levels against the Euro.

Markets will remain sensitive to official rhetoric on currencies ahead of G7 and IMF meetings at the end of this week. There will also be further speculation that this would be a politically-advantageous time for China to announce a shift in its exchange rate regime which should underpin the yen.

Sterling

There were sharp Sterling losses to below 1.5250 against the dollar on Monday. A spike in uncertainty over the May 6 election result following weekend opinion polls was important in undermining confidence while global risk appetite was also still weaker.

Political uncertainty will remain a key feature, especially with speculation over the impact of an indecisive election result on Sterling and sentiment is likely to remain generally weak.

The economic data due for release over the next few days will also be important for Sterling sentiment with important releases on growth, inflation and government debt levels. A higher than expected consumer inflation report on Tuesday would provide some degree of Sterling support, although the principal impact could be to increase volatility.

Sterling found support below 1.52 against the dollar and as risk appetite stabilised the UK currency was able to recover back above the 1.53 level later in US trading. The Euro was struggling to hold above the 0.88 level against Sterling.

Swiss franc

The dollar moved higher to 1.0685 against the franc in European trading on Monday, but failed to sustain the gains and weakened back to the 1.0630 area. Although it held above 1.43, the Euro was unable to make any impression against the Swiss currency.

The Swiss currency will continue to gain underlying support from a lack of confidence in the Euro-zone economy, especially if there are further stresses within the bond markets.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

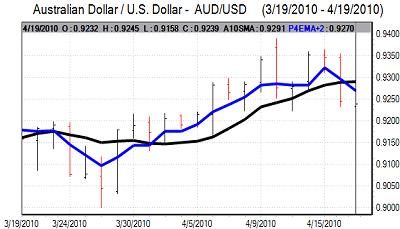

Australian dollar

The weaker Australian dollar trend continued in local trading on Monday with a decline to lows near 0.9160 before a limited recovery. There will also be unease over the risk of a Chinese yuan revaluation which will deter Australian buying support.

The currency was able to regain some buying support later in the US session and moved back to the 0.9230 area against the US dollar.