EUR/USD

The Euro continued to find support close to the 1.30 level on Thursday with short-term funds unable to trigger stop-loss selling below this level. This failure helped trigger a short-covering rally for the currency as the dollar also succumbed to profit taking as it hit important resistance areas.

There were persistent doubts surrounding the Euro-zone outlook with speculation that Portugal and Ireland could require additional bailouts. Markets were also expecting the ECB to maintain an aggressive monetary policy to help salvage the banking sector which dampened demand for the Euro.

US jobless claims fell to 351,000 in the latest reporting week from 365,000 previously maintaining a run of generally favourable labour-market data. There were robust readings for the regional PMI indices as the New York Empire index rose to 20.2 from 19.5 the previous month, although there was a dip in the orders component. There was a similar pattern in the Philadelphia Fed index as a rise to 12.5 from 10.2 masked a weaker reading for orders which may trigger some unease over the second-half growth outlook.

There was a stronger than expected reading for long-term capital inflows with a rise to US$101bn for January from 19.1bn previously. There will be relief that there was a rise in inflows, especially with concerns that China had been shifting funds out of US Treasuries and should provide some fundamental dollar support.

The US currency maintained its yield advantage which helped limit pressure for profit taking and the Euro stalled in the 1.31 with some choppy trading conditions following the reports that some of the Strategic Petroleum Reserve would be released into the market. A pattern of slight dollar weakness continued in Asian trading on Friday with narrow ranges.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to regain the 84 level against the yen on Thursday and dipped sharply to lows near 83.25 before stabilising. The dollar was vulnerable to a significant correction following recent sharp gains. The solid US data releases helped maintain US yield support and also curbed any momentum for the yen.

There were reports of increased exporter selling and there will also be speculation that the Ministry of Finance has been actively engaged in pushing the yen weaker in order to provide better levels for Japanese companies to hedge export earnings ahead of the fiscal year-end at the end of March.

The latest Bank of Japan minutes recorded that some members had considered the option of a higher 1-2% inflation goal, although the majority view was in line with expectations with the dollar consolidating above 83.25.

Sterling

Sterling found support on dips to below 1.5650 against the US dollar on Thursday and secured a significant advance during the US session with a peak above the 1.5720 region. The UK currency also found support close to the 0.8350 region against the Euro.

There was still some negative impact on the UK currency from the Fitch announcement that the UK credit rating was put on negative watch. The timing of the announcement was particularly significant with the UK budget due next week. There was speculation that the government would be forced to take a more restrictive stance on fiscal policy to help bolster international sentiment. This would maintain expectations that there would be a loose monetary policy which curbed demand for the UK currency while there was some decline in defensive Sterling demand as immediate Euro-zone fears eased.

Swiss franc

The Swiss National Bank announced no change to interest rates at the latest policy meeting with interest rates held below 0.25%. The central bank also announced that the minimum 1.20 Euro level would be maintained and that it would be defended aggressively.

Interim Bank Chairman Jordan stated that the franc was still very, very strong, maintaining some speculation that the minimum Euro level could be increased over the next few months.

There was still disappointment that there was no move to weaken the franc further at this meeting and the Euro weakened to lows around 1.2065 against the Swiss currency. The dollar was unable to regain the 0.93 level and dipped to test lows near 0.92 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

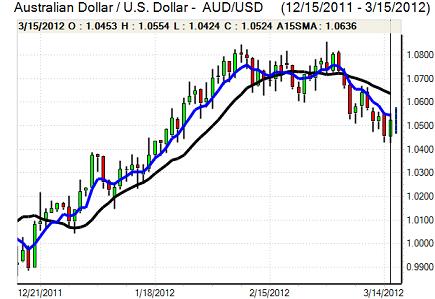

Australian dollar

The Australian dollar was able to resist a further test of support in the 1.0450 area against the US dollar on Thursday and pushed to highs around 1.0550, in line with a wider retreat for the US currency.

The currency edged lower in Asian trading on Friday with some evidence of longer-term capital outflows from the Australian currency which was offset by a slightly more positive near-term mood as equity markets held firm and there were no major fresh incentives during the Asian session.