EUR/USD

The Euro held a firm tone in Asia on Monday, with relatively narrow ranges as there were no major fresh developments with the G7 meetings not having a major impact.

The Euro was unable to secure any further advance during the day and steadily declined later in the session. There was substantial selling pressure on the European crosses which pushed the currency weaker against the dollar. There were persistent fears surrounding the Euro-zone financial sector which continued to undermine the currency. The latest money-supply data recorded an annual 0.2% annual decline which will maintain pressure on the ECB for a loose monetary policy.

The second-tier US economic data did not trigger any significant move in the currency markets. Despite a modest increase in incomes, consumer spending only edged marginally higher and this will tend to reinforce unease over second-half spending trends.

Federal Reserve Governor Warsh maintained caution towards the potential for renewed asset purchases. Nevertheless, there is growing speculation that the Federal Reserve will have to consider further monetary measures within the next few months to help stave-off any renewed threat of deflation.

In this environment, the dollar is unlikely to gain any significant support on growth grounds. There is still the potential for defensive support if global growth fears intensify. Euro weakness on the crosses dominated and the currency dipped to lows near 1.2265 during the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The domestic Japanese data recorded a 2.8% annual increase which was the 5th successive gain for sales, although this was slightly weaker than expected. Moody’s also maintained a cautiously positive stance on Japanese government reform efforts which is likely to provide some degree of yen protection.

Risk appetite held firm following the G20 meetings which lessened defensive yen demand to some extent. The dollar found further support close to 89.20, but was unable to make any significant headway as there were reservations over aggressive yen selling.

The US currency dipped to 5-week lows against the Japanese yen on underlying doubts over the financial sector before a limited recovery to 89.40 later in the US session as Wall Street attempted to rally.

Sterling

There was a slight Sterling drift lower in Asia on Monday, but movement was limited and the UK currency held above the significant 1.50 technical support zone against the dollar.

Trends on the crosses remained important during the day and the UK currency pushed to re-test 19-month highs against the Euro with a peak near 0.8150. This also helped Sterling maintain a firm tone on the dollar with a high above 1.51.

There was further speculation that the fiscal action would strengthen the structural outlook and help protect credit ratings. Sterling was also boosted by comments from Bank of England MPC member Sentance who stated that he still favoured an interest rate increase following the UK budget.

Confidence in monetary policy could still prove to be very brittle given the growth doubts which could trigger renewed selling pressure on the currency within the next few weeks, especially if there are renewed doubts over the financial sector.

Swiss franc

The dollar was unable to make significant headway in early Europe on Monday and there was renewed selling pressure on the US currency during the European session as cross-rate movement continued to have an important impact.

National Bank member Danthine repeated comments that the deflation threat had disappeared and this put further selling pressure on the Euro against the franc with fresh record lows near 1.33, maintaining the substantial sell-off seen during June.

In this environment, the dollar dipped to lows just below 1.0820 before a tentative recovery to 1.0860 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

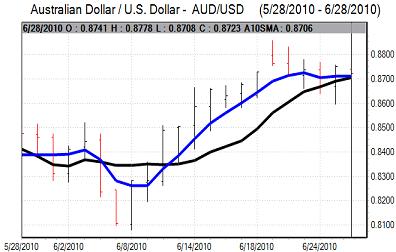

Australian dollar

The Australian dollar held a firm tone in local trading on Monday, but was unable to extend Friday’s gains. A dip in New Zealand consumer confidence also had some negative impact on sentiment surrounding the Australian economy, although the impact was limited.

With global risk appetite also still relatively fragile, the Australian dollar weakened to a low close to the 0.87 level against the US dollar in US trading with a dip in commodity prices also having some negative impact.