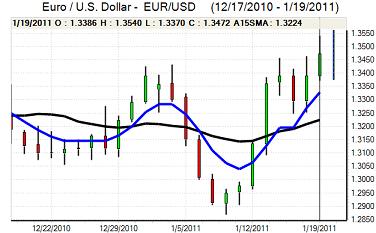

EUR/USD

The Euro maintained a firm tone during the European session on Wednesday and advanced to a fresh 8-week peak above 1.3520 against the dollar. There were persistent suggestions of Euro buying by Far East central banks which underpinned the currency, especially as theses reports also maintained expectations of Asian interest in forthcoming Euro-zone bond issues.

There was still a high degree of uncertainty over the Euro-zone capital markets, especially with contradictory remarks from German government officials. There were reports that the government would seek to restructure Greek debt, but these reports were later denied. It is clear that there are very important divisions within Germany and throughout the Euro area. Without a clear policy, there will be a high risk that the current relative calm over solvency fears will not be sustained.

There is also a high risk of further sovereign credit-rating downgrades within the next few weeks which would tend to undermine Euro confidence.

The US housing data was mixed as a weaker than expected 4.3% decline in annualised housing starts was offset by a strong rise in building permits to the highest level for more than 12 months. The gain in permit will maintain some hopes that the sector can improve this year.

The US banking-sector earnings results were generally weaker than expected which undermined risk appetite and this did lead to some defensive dollar support. The Euro was also vulnerable to a corrective retreat and dipped back to find support below 1.3450.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained under pressure against the yen during Wednesday and retreated to lows around 81.85 before staging a modest recovery. There were further reports of semi-official dollar buying support below 82 and this was important in curbing dollar selling.

The latest monthly Tankan business confidence survey recorded a further improvement which will offer some reassurance over near-term growth prospects. The Finance Ministry will still be opposed to yen strength and there is a heightened risk of verbal intervention if the currency advances further.

The Chinese growth data was stronger than expected and there were renewed fears that China would have to tighten policy further in the near term to curb inflationary pressure. These fears will tend to undermine risk appetite and also provide some yen support.

Sterling

Sterling fluctuated around the 1.60 level against the dollar during European trading on Wednesday, but was unable to hold a position above this level, especially once the US currency rallied from intra-day lows.

As far as the economic data is concerned, the headline UK labour-market data was slightly better than expected with a small decline in claims for December. The unemployment rate was unchanged and the employment data suggested that conditions were generally weak which curbed Sterling support.

There were also further uncertainty whether the Bank of England would be in a position to increase interest rates at a time when the economy is set to weaken. There will be some speculation that the bank will decide it has to tolerate higher inflation in the near term and such a policy would risk a serious deterioration in medium-term Sterling confidence.

There were also some further doubts surrounding the UK banking sector after weaker than expected earnings reports from the US institutions. Sterling weakened to lows just beyond 0.8450 against the Euro and dipped to 1.5920 against the dollar before finding support.

Swiss franc

There was further volatile trading in the Swiss currency on Wednesday with the Euro strengthening to near 1.30 before retreating back to lows below 1.2850. The dollar retreated to lows near 0.9520.

An announcement of a government news conference on the Swiss franc increased market speculation that there could be further action to weaken the currency. In the event, the main focus was on additional support for hard-pressed sectors such as tourism and the government reiterated that the National Bank had sole responsibility for franc policy.

These comments reversed initial franc selling and the currency will also gain support if fears surrounding the Euro-zone increase again.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian currency maintained a firm tone during European trading on Wednesday and pushed to a high around 1.0070 against the US dollar.

There was a general deterioration in risk appetite during the US session which undermined Australian dollar support and there was also renewed speculation over additional Chinese monetary tightening which lessened support for commodity prices and the Australian currency.

In this environment, the currency weakened back to lows just below 0.9950 against the US dollar during Asian trading on Thursday as regional equity markets declined.