After what looked like a good recovery, there are signs that Northeast Manufacturing is in shap decline.

After what looked like a good recovery, there are signs that Northeast Manufacturing is in shap decline.

Jobless numbers are on the upswing as temporary holiday hiring is being trimmed faster than census jobs can pick up the slack. We had a big build in inventories in Q4 as clearly manufacturers were overly optimistic and a sharp rise in commodity prices during the quarter didn’t help much either. We get the official report at 10am today and the most optimistic expectations have us down about 10% from last month’s 20.4 reading so we can expect today’s report to move the market one way or the other.

Not to worry though because, as Jonathan Weil points out in Bloomberg today, “the fix is in” on Wall Street as the 10-member Financial Crisis Inquiry Commission has been given 11 months and $8M to examine the causes of the financial crisis, including Fannie Mae’s 2008 meltdown and the near-deaths of at least 10 other major financial institutions, including Lehman Brothers Holdings Inc., American International Group Inc. and Citigroup. The statute that created the commission says its report specifically must tackle the role of regulators, monetary policy, accounting practices, tax policy, fraud, capital requirements, credit raters, executive pay, derivatives and short selling — plus a dozen other required areas of study.

Wow, that’s a lot of ground to cover! To put in perspective what a joke this is, Weil points out that when Fannie Mae hired former U.S. Senator Warren Rudman in 2004 to investigate how its accounting practices had gone awry, his law firm’s final report took 17 months to complete and cost the company more than $60 Million. $60M in 2004 to investigate ONE firm over 17 months and Congress has allocated $8M over 11 months to investigate a DOZEN firms as well as get an overview of the entire financial system. What are the odds the commission can conduct all these investigations by mid-December and do a thorough job? About zero, which clearly was Congress’s intent all along. If this is a joke, it’s a bad one and it’s on US!

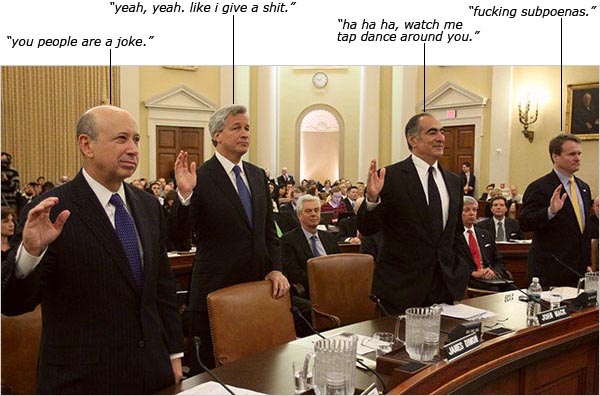

This is why we’re bullish on the markets (or the market manipulators, at least) – fundamentals don’t matter! The banksters have taken control of government and are flat out laughing at us, the citizens of the US (and the world) as we cry “foul” and try to reign in the madness. This is not just a US problem, it’s a global problem but you…