Option Sellers have Many Choices when it comes to taking Premium. Here is how to select your strikes like a Pro.

Embarking on an option selling campaign can be an exciting new way to invest for investors used to trying to “buy low and sell high.” But the choices available to new option sellers can be daunting.

Ideally, you want to pick options that not only expire worthless, but quietly decay to zero – preferably well before expiration. Your objective is to find these and avoid the ones that could potentially go in the money prior to expiration.

Therefore, while there are no hard and fast rules for selecting the “best” options to write for your commodities portfolio, here are presented some general guidelines that may help you.

Three Guidelines for Successfully Selling Commodity Options Consistently

1. Know your Fundamentals. Unlike equities, commodities are almost always dependant on their physical supply/demand fundamentals for their ultimate price direction. While institutional money or public sentiment can still play a role in commodities in the short term, a massive list of commercial players are buying and selling the futures contracts to hedge actual usage or production of the commodity.

Supply/Demand fundamentals play a sizable role in determining future commodity prices

These commercial traders are keenly aware of the actual supply and demand for these products. You should be too.

Fundamentals can give you a fairly clear idea of where prices will not go and provide you with an advantage over the average commodity investor who is simply following a chart. Combining this knowledge with a high percentage strategy such as option selling can be a potent combination. There are many good sources of fundamental data for investors such as the USDA, the EIA, news wire services or private subscription sources. We get our data and information from a variety of sources. However, if you have the time to do your own research, one or two good sources of fundamental info should be all you need.

2. Sell Deep out of the Money. Select markets where premium is available deep out of the money. 30, 40, 50 sometimes even 100% out of the money. Rarely possible in stocks. Quite feasible in commodities. This forces the market to make an extreme move against your position to put the option in the money. It also allows you to manage your risk based on the option value – not on the price of the underlying or it’s proximity to your strike.

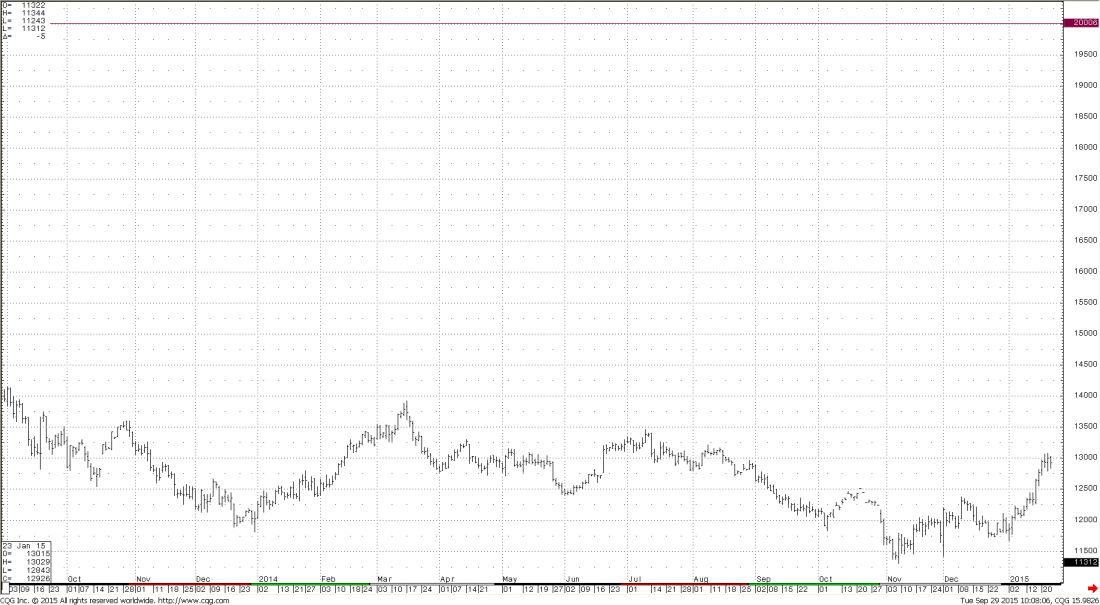

June 2015 Gold

As gold prices surged in early 2015, call strikes were available at 50% out of the money and more. The chart above illustrates selling a June Gold 2000 call in January, with gold prices hovering near $1300 per ounce.

3. Trade Time for Distance: Many books and courses that address selling options will advise selling options within 30 days of expiration to gain the fastest time decay. While this may make sense for option sellers collecting premium on open stock positions, I couldn’t disagree more when it comes to pure premium collection in commodities.

Getting any significant premium with this little time means selling close to the money – too close for a person that enjoys their sleep as much as I do. Close to the money strikes may decay quickly if you are right the market. But even a temporary fluctuation can put your option in the money. Guessing short term market direction is exactly what you are trying to avoid by selling options. Be willing to sell options with more time (3-5 months) and much further out of the money. If your fundamental synopsis is even close to being right, these trades should work well for you.

Of course, selecting the right strategy, managing risk and structuring your portfolio are all important too. But selecting the right options to sell is where you start. Whether you sell commodities options yourself or have a professional doing it for you, knowing how options are selected can make you a more effective trader, or a better informed investor – whichever you choose to be.

Resource: For more information on selecting the right options to sell for your portfolio, see chapters 7, 11 and 13 of The Complete Guide to Option Selling, New 3rd Edition (www.OptionSellers.com/Book)

By: Michael Gross, James Cordier, OptionSellers.com

***The information in this article has been carefully compiled from sources believed to be reliable, but it’s accuracy is not guaranteed. Use it at your own risk. There is risk of loss in all trading. Past performance is not necessarily indicative of future results. Traders should read The Option Disclosure Statement before trading options and should understand the risks in option trading, including the fact that any time an option is sold, there is an unlimited risk of loss, and when an option is purchased, the entire premium is at risk. In addition, any time an option is purchased or sold, transaction costs including brokerage and exchange fees are at risk. No representation is made that any account is likely to achieve profits or losses similar to those shown, or in any amount. An account may experience different results depending on factors such as timing of trades and account size. Before trading, one should be aware that with the potential for profits, there is also potential for losses, which