Today’s Golden Sunrise

Tuesday, April 6th

The dollar up, the stock indexes hitting new highs, breadth and depth to the move, gold & commodities all rising..but so are interest rates.

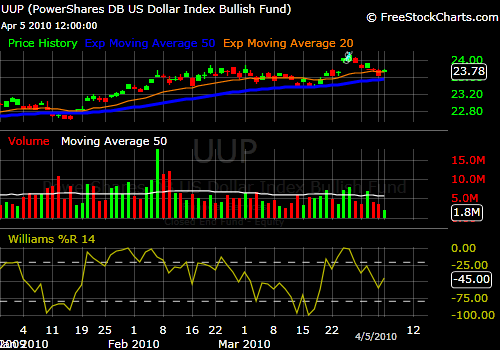

The dollar etf…volume doesn’t show much enthusiasm.

The dxy…60% weighted to the Euro: back4 a few week ago when I showed the channels with the headed to upper channel ..hit that and reversed to the lower channel..if it heads back to upper channel, that level is going to be pretty high..83-84

The SPY=S&P500..usually down the $ is up: overbought, low volume

The rocketing, small-cap Russell…steeper version of the same story:

The financials to provide some additional breadth: same story here as well-volume has collapsed.

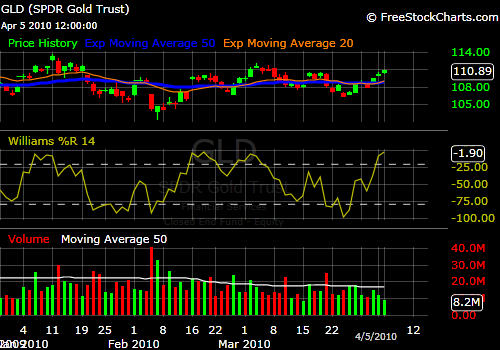

Strong dollar has been bad for gold and commodities: up here too and overbought and no volume.

Copper…the metal with the PHD in Economics (that used to not be an insult).. jjc, the etf for you and me. Same picture, different heading.

Oil…Chinese demand is taking up the US slack

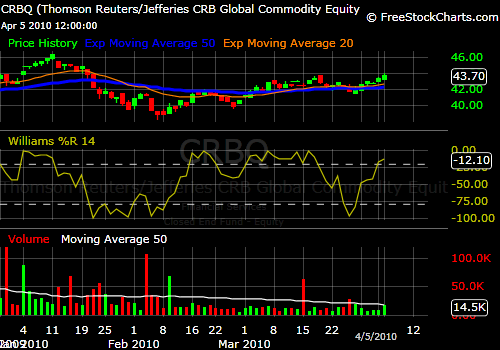

Global commodities across the board: volume is pathetic

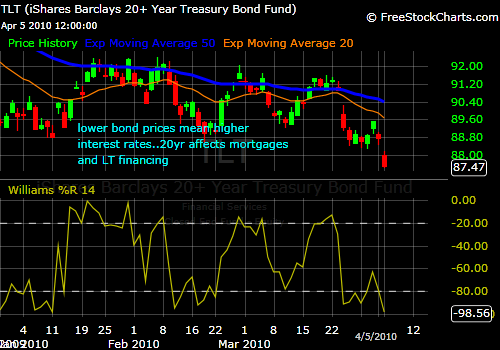

Not so good-interest rates-going higher..market historians might recall brief periods when stock markets went up with interest rates but they would have found very short stories: a gap up!

And scariest of all, with all that money that flowed into this safe haven..bonds.. the etf TLT-a gap down and finish at the lows

Yesterday was another move-up Monday, the window dressing still in effect, the IRA and pension contributions for the beginning of the month and the quarter into the intermediaries for deployment, everyone bullish, all the problems with Greece and Iceland and the states of CA and IL out of the news have led to eternal spring in the stock market.

The bond market/interest rate scenario might not be taking away the punch bowl but it might be leaking into it.

JohnR

Goldensurveyor.com

much more on the website for subscribers

Golden Sunrise is the Golden Surveyor’sbroad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!