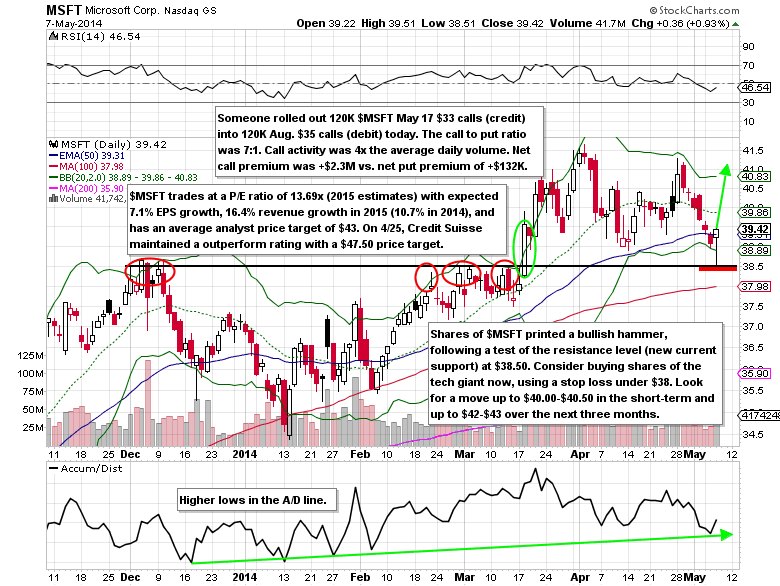

Shares of Microsoft (MSFT) are up 6.17% year to date, but have pulled back 5.38% from the April highs. Microsoft currently trades at a P/E ratio of 13.69x (2015 estimates) with expected 7.1% EPS growth, 16.4% revenue growth in 2015 (10.7% in 2014), 2.84% dividend yield, and has an average analyst price target of $43. On April 25th, Credit Suisse (CS) maintained an outperform rating with a $47.50 price target. The next ex-dividend date is on Tuesday, May 13th. The $0.28 dividend will be payable on Thursday, June 12th.

Unusual Options Activity

On Wednesday, May 7th, someone rolled out 120k May 17 $33 calls (credit) into 120k Aug. $35 calls (debit). The call to put ratio was 7:1. Call activity was 4 times the average daily volume. Net call premium was +$2.2M vs. the net put premium of +$132K.

Technical Analysis

Shares of Microsoft printed a bullish hammer on the candlestick chart (long lower wick with a short body that has little or no upper wick) on the same day of the big call rollout, following a successfully test of the former resistance level (new current support level) at $38.50. Consider buying the stock now, using a stop loss under $38. Look for a move up to $40.00-$40.50 in the short-term and possibly up to $42-$43 over the next 2-3 months. The reward/risk ratio is better than 2.5:1.

Microsoft Options Trade Idea

Buy the Aug. $39/$43 call spread for a $1.40 debit or better

(Buy the Aug. $39 call and sell the Aug. $43 call, all in one trade)

Stop loss- None

First upside target- $2.60

Second upside target- $3.90

Disclosure: I’m long the Aug. $39/$43 call spreads for a $1.29 debit.

= = =

Mitchell’s Free Trade of the Day featuring Caterpillar (CAT)