iShares MSCI Japan Index (EWJ) is an ETF whereby investors are able to track the performance of the Japanese equity market, specifically the MSCI Japan index.

ETF HOLDINGS

EWJ’s two largest holding are Toyota Motor Corp (comprising 5.94 percent of assets) and Mitsubishi UFJ Financial Group, the world’s second largest bank holding company, which accounts for a 3.28 percent stake.

Broken down by sector– financials and consumer discretionary account for the largest percentage of holdings, at 21.84 and 20.54 percent respectively. Industrials make up 18.73 percent of holdings, and information technology come in fourth 10.25 percent of assets (source: BlackRock).

BIG EQUITY GAINS

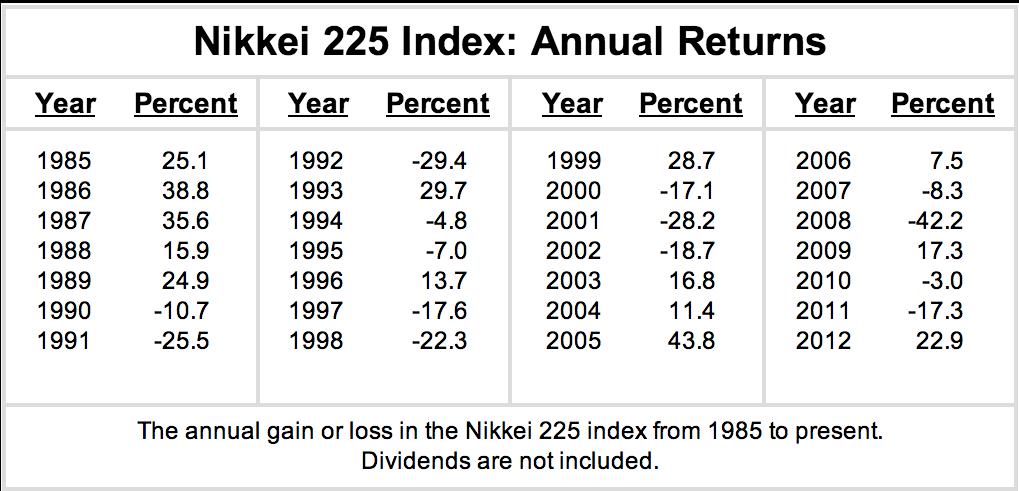

Japan’s Nikkei 225 Stock Average, up an astounding 59 percent since last year’s June 4 low, seems poised to touch a 4 1/2 year high on speculation that the ultra-dovish course of action taken by the Bank of Japan (BoJ) will see an increase in corporate profits.

The index was up 10% in the four sessions since the BoJ went into its two day meeting, the result of which is a monetary easing program of unprecedented proportion. Aimed at tackling persistent deflation aggravated by an aging population, bank officials announced an increase in monthly bond purchases to 7.5 trillion yen (76 billion USD) as means to achieve its two-year inflation target of two percent.

Figure 1 source: forecastchart.com

AGGRESSIVE MOVE

The BoJ’s plan to inject 1.4 trillion USD into its economy dominated international finance headlines over the weekend, drawing praise from such officials as IMF Chief Christine Lagarde. She stated “Monetary policies, including unconventional measures, have helped prop up advanced economies, and in turn, global growth,” citing the U.S. recovery as having ‘picked up steam’ while speaking in south China.

Lagarde added on a more cautious note, “There is…a limit on how long monetary policy can…shoulder the lion’s share of this effort.” Japan’s government debt is approximately twice the size of it’s 5 trillion USD economy, the highest proportionally among developed nation.

MILITARY TENSIONS

Increasing military tensions on the Korean peninsula led to the South Korean won to fall to its lowest level since September of last year, with the Won 1,136.76. At writing time the spot for USD/JPY was 99.2750, firmly within striking distance of the Yen 100 level.

MY TRADE

Buying the EWJ Jan 2014 11-13 Call Spread for $0.55

Risk: $55 per 1 lot

Reward: $145 per 1 lot

Break-even: $11.55