Recent earnings in the tech space have left a lot to be desired, putting the Nasdaq Composite and Nasdaq 100 in vulnerable positions. The good news is that I’m still seeing plenty of decent technical setups out there outside of the technology sector. The question is: Will fresh institutional money come in from the sidelines between now and the end of the year? My take is that with the U.S. Dollar Index looking as weak as it is — not to mention bonds — the bull case for stocks is still a compelling one.

OTHER ANGLES

If you’ve missed the recent run in the home builders, don’t worry. Instead of chasing them when most are well past proper entry points, focus on ancillary plays — firms that stand to benefit from a continued recovery in the housing market.

UNDER ACCUMULATION

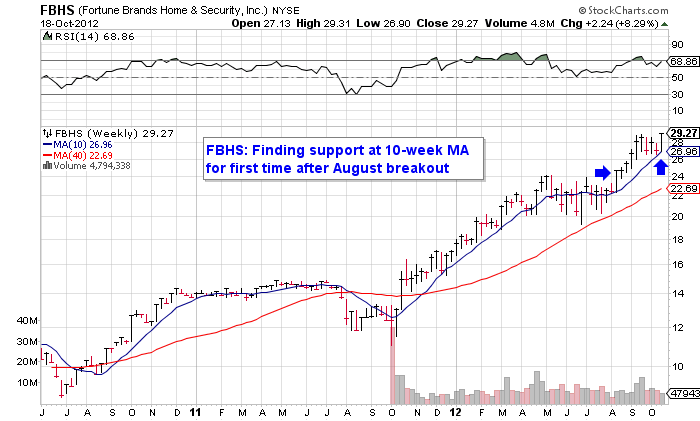

Fortune Brands Home & Security (FBHS) is one such stock, and shares remain under accumulation. It was spun off by Fortune Brands (FO) a little over one year ago. Similar to women’s retailer Chico’s FAS (CHS) — profiled last week in this space — FBHS is firming up at its 10-week moving average for the first time after a breakout in August. It’s just the kind of supporting action you want to see after a breakout.

EARNINGS ON TAP

The provider of home security, kitchen and bath and tool storage products for the home-building market is scheduled to report earnings on October 23. It’s expected to earn $0.25 a share, up 32% from a year ago with sales up 6% to $899.6 million. Some of its brands include Master Lock and Moen faucets.

WAIT AND SEE

Full-year profit in 2012 is seen rising 40% from 2011 and 35% in 2013. If you miss an initial base breakout in a stock, buying after a successful pullback to the 10-week moving average is perfectly acceptable strategy. Since earnings are so close, however, I’d rather wait and see what earnings look like before buying shares. Its fundamental and technical is strong and I’m expecting a solid quarter next week. If big buyers come into the stock, I will follow their lead.

[Editor’s note: Ken provides live market analysis every day on the TFNN radio network, hosting a daily call-in talk show — Breakout Investing — from 3-4 ET. You can listen live. Tune in today.]