EUR/USD

The US employment data was substantially weaker than expected even though expectations had been downgraded following poor ADP data with a non-farm payroll increase of 54,000 for May compared with a downwardly-revised 232,000 for April while the unemployment rate increased to 9.1% from 8.9%. There was a decline in manufacturing employment while the government sector continued to contract

The PMI non-manufacturing index moved higher to 54.6 from 52.8 previously, after the sharp decline recorded in May. Despite some relief over the PMI data, the releases as a whole maintained expectations that the US economic outlook had deteriorated following a stream of weaker readings. In response, US Treasury yields remained lower which undermined potential yield support for the US dollar. The US currency was also unsettled by further unease over the debt fundamentals, especially following warning from Moody’s that it could consider a ratings downgrade if there was no progress on raising the debt ceiling. The dollar gained some ground as risk aversion deteriorated following the data, but then weakened sharply later in the New York session.

The Greek situation also remained a very important market focus during the day. There were strong expectations that the next loan tranche to Greece would be paid this month which helped underpin Euro sentiment. There were also expectations that there would be a new support package for Greece with strong pressure for private creditors to accept replacement bonds with a longer maturity.

These plans could still be threatened if the Greek government is unable to secure support for additional austerity measures and uncertainty will remain very high. There were expectations that the ECB would signal a July interest rate hike at this week’s meeting and this helped push the Euro to a 1-month high around 1.4650.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar consolidated close to the 80.70 area against the yen ahead of Friday’s employment data as caution inevitably prevailed. The US currency dipped sharply following the data and, despite a strong bounce from the 80.10 area, the dollar was subjected to renewed selling pressure later in the US session.

The dollar was undermined by a drop in yield support as markets continued to price out any potential increase in the Fed funds rate during the second half of 2011 and yield support is liable to remain weaker in the short term.

The yen also gained some defensive support as risk appetite generally deteriorated following the US release, although there was some relief that immediate Euro-zone fears eased which helped lessen defensive yen demand. The yen was hampered by ratings pressures and fears that political deadlock would block debt-reform measures.

Sterling

The UK services PMI data was weaker than expected with a decline to a 3-month low of 53.8 for May from 54.3 previously as business confidence deteriorated.

The data reinforced market expectations over a further slowdown in the US economy and the currency weakened to a low just below 1.63 against the dollar. Thereafter, the US data tended to dominate and there was a recovery to a peak near 1.6450 even though the UK currency weakened to lows beyond 0.89 against the Euro.

Underlying confidence in the UK economy remained weaker, especially with another round of criticism of government’s economic policies from leading economists. The IMF’s latest assessment, due on Monday, will be watched closely this week and a negative report would further damage sentiment.

Sterling was also damaged by expectations that the Bank of England would again decide against an increase in interest rates at this week’s MPC policy meeting.

Swiss franc

The dollar was unable to gain any relief against the franc during Friday and retreated to a fresh record low below 0.8350 following the US employment data as volatility remained extremely high. The Euro continued to find support below 1.22 even though rallies quickly attracted selling pressure.

The franc continued to gain defensive support from a general deterioration in risk appetite and it was noteworthy that expectations of a fresh support package for Greece failed to trigger any substantial selling pressure on the franc against the Euro. There will be further pressure on the National Bank to address excessive currency strength, although demands will be lessened by the robust tone of recent market indicators.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

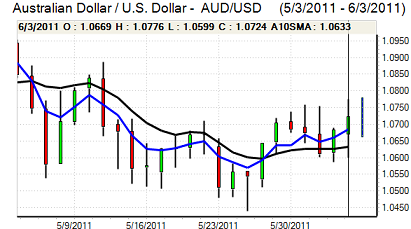

Australian dollar

The Australian dollar was again subjected to volatile trading during Friday and after a temporary dip to test support in the 1.06 area against the US dollar following the US employment data, the currency rallied strongly to a high above 1.0750.

There was additional yield support for the Australian currency as US yields declined and there was relief that there was no further announcement of higher interest rates from the Chinese central bank.

The currency was still hampered to some extent by a general deterioration in risk appetite as fears over the global economy increased.