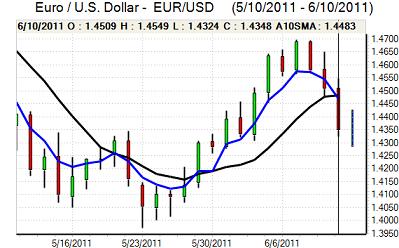

EUR/USD

The Euro was unable to break back above 1.4550 during European trading on Friday and was subjected to fresh selling pressure during the US session with lows below 1.4350 late in the New York session.

Following the ECB press conference on Thursday, there was some further downgrading of interest rate expectations which curbed yield support for the Euro with markets pricing out one of the rate increases which had been expected late in 2011.

Structural considerations also remained extremely important as political wrangling surrounding the Greek debt situation persisted. The German government and Euro-group head Juncker continued to insist that there would be need to some for of voluntary debt restructuring as part of any fresh support package for Greece. In contrast, the ECB continued to insist that there should be no form of default event. The lack of resolution surrounding the affair continued to undermine confidence in the Euro and there were fresh fears that European banks were withdrawing funds from weaker economies.

There were no major US economic releases during the session, but there was a deterioration in risk appetite as commodity prices came under pressure and there was a further sharp decline in equity prices as Wall Street retreated again. There was a renewed increase in speculative short dollar positions according to the latest data which will maintain the potential for a closing of positions which will also tend to underpin the dollar

Confidence is likely to remain weaker in the short term with further unease surrounding the international growth outlook. Given a lack of confidence in the US fundamentals, it will still be difficult for the US currency to make much independent headway even with safe-haven support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to break above 80.40 against the yen during Friday and dipped to test support near 80. There was solid US support on dips which helped support the US currency with further evidence of semi-official buying at lower levels.

Global risk conditions were generally more fragile which helped support the yen, especially as global equity markets were subjected to renewed selling pressure. There will also be expectations of capital repatriation from the Euro-zone which will underpin the Japanese currency over the next few weeks.

There was further speculation over potential G7 intervention to weaken the yen which also helped curb speculative yen buying.

Sterling

After holding steady in early Europe on Friday, Sterling was subjected to renewed selling pressure. There were rumours of a weaker than expected industrial production report and the data was certainly much worse than expected with a 1.7% decline for April. The data is volatile on a monthly basis, but there were renewed fears over the economy, especially as a sharp production decline would suggest that exports are not making any headway.

Sterling was also undermined again by weaker yield support following the Bank of England decision to leave interest rates on hold. Overall confidence in the economy remained weak with markets fretting over the serious debt implications if there is no improvement in the growth environment.

Sterling did hold its own against the Euro with gains to the 0.8840 area, but there was further selling pressure against the dollar with a retreat to lows below 1.6250.

Swiss franc

The dollar found support on dips to below 0.84 against the franc on Friday, but it was unable to make any significant progress and was capped below 0.8450. The franc secured a fresh surge on the crosses with the Euro retreating to near record lows below 1.21.

Safe-haven considerations will inevitably remain a key short-term influence, especially with no resolution to the Euro-zone sovereign-debt crisis. There will be caution ahead of Thursday’s National Bank policy meeting given the possibility of intervention to weaken the franc, although the central bank will find it very difficult to justify such a policy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

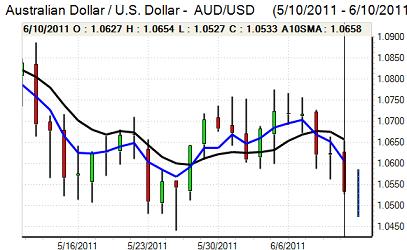

Australian dollar

The Australian dollar was blocked above 1.0630 against the US dollar during Friday and retreated sharply during the New York session as volatility also spiked higher again.

The Australian dollar was undermined by a fresh deterioration in risk appetite as equity markets and commodity prices fell in tandem. There will be further concerns over the global growth outlook which will remain a negative factor for the Australian currency with a downgrading of Asian growth expectations, especially damaging. There will also be fresh doubts over the domestic economy which will also tend to curb currency support.