By FX Empire.com

Portugal, Italy, Greece and Spain = PIGS and then there is Ireland

Banking Systems Most Exposed to PIIGS Nations – 3,2 trillion USD

[/caption]

Now that the angst that swept through the markets in the past few weeks has been shrugged off investors are starting to believe that there will be a solution for Europe’s debt problems. And that perhaps, the EU will in its own way, will guide the economies of the eurozone through this hellish nightmare.

The Greek Parliament approved crucial new austerity measures and European leaders began to work out a plan to reduce Athens’ financing needs and throw a new lifeline at the debt-stricken country. They are slow and take baby steps, while the world pushes them for action, they are planning. It seems there are too many politicians and lawmakers that love the spotlight and cannot resist speaking to the press. Unfortunately too many investors act and react to these statements, which are never followed by disclaimers that the statements are not fact only beliefs or views at the moment from the speaker.

The caution mode has not been switched off and some say that Greece might still be forced to undergo a full-on default in the long run, harming other peripherals, including Portugal and Italy, along the way. In this worst-case scenario, where debt holders would be forced to accept losses on their investments, some stand more to lose than others.

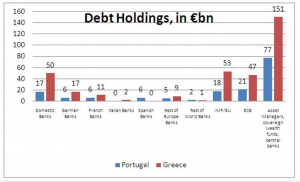

According to data from RBC Capital Markets, the European Central Bank, Germany, France and Spain are on the front line among individual holders, both in regard to Portuguese as well as Greek debt:

The ECB became exposed to debt from the peripheral countries as European banks were pushed aside from financial markets, and the central bank was forced to support the financial system. The ECB can handle the strains, they are also able to issue money and monetary policy as well as successfully sell bonds and raise liquidity. On one hand, the ECB allowed banks from the troubled eurozone economies to borrow as much as they needed via the refinancing operations, even by handing in collateral that was below investment grade. On the other hand, the ECB started a bond-buying program in secondary markets, and in mid-June it had purchased a total of EUR74bn, according to data from the ECB. Today the ECB will announce the value of the second of these issues, which is taking place currently. The ECB continues to flood the markets with liquidity and assurances.

Huge risks have been transferred from struggling governments and banks onto the ECB’s books, with taxpayers as the ultimate guarantor. There’s a real risk that these assets will face radical write-downs in future.

Germany and France are among Portugal’s and Greece’s major creditors. According to RBC Capital Markets, German banks hold EUR23bn of debt from the two nations, while French banks have EUR17bn.

If write downs to bonds of these countries were to come about, this would leave them in a tight spot, since banks would be forced to write down the value of debt holdings on their balance sheets

Portugal will not follow Greece’s footsteps – but it could need more time. For Portugal more than the other two countries the issue is economic growth rather than fiscal adjustment. With a program of only three years duration, it is not certain Portugal will have made sufficient progress to fully reassure markets of its long term sustainability by the end of 2013.

Italy, like Greece and Portugal , is under pressure from international creditors to bring down its massive national debt. But its economy is so big that an Italian default could bring about the collapse of the entire euro system. In a recent interview Prime Minister Monti said, “The consequences would have been extremely serious for Italy, had a default of Greece happened a few months ago. Now – in fact — of course, I hope that there is not a default for Greece, but I’m really confident that even in that case Italy is seen by the markets and by the E.U. institutions and by the global community as a country which, since a few months, has really taken some tough structural measures, both as regards the budgetary consolidation and as regards structural reforms for growth.” Italy’s huge debt has the markets very worried.

At roughly 120 percent of GDP, its growth-hobbling government debt is second only to Greece’s among euro zone members. Although it has run a budget surplus, minus debt costs, for several years, the Italian government spends about 16 percent of that budget on interest payments — a bill that began to rise in the summer of 2011 as investors and creditors began to fear that Italy cannot escape Europe’s debt crisis.

As a result, the country has increasingly taken center stage on the debt crisis, as the amount of Italy’s debt held by foreigners — nearly 800 billion euro — is more than that of Greece, Ireland and Portugal combined. The debt problem is compounded by the country’s economic slowdown — in December 2011, the government’s minister for economic development proclaimed that Italy had already entered a recession.

Europe is not out of the crisis yet, more will continue to unfold in a short time.

Originally posted here