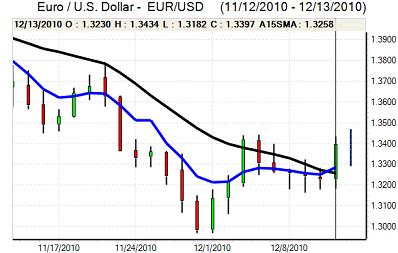

EUR/USD

The Euro found support below 1.32 against the dollar on Monday and then rallied strongly during the New York session as the US currency came under significant selling pressure on fundamental and technical grounds.

There was a decline in US Treasury yields during the day which undermined the dollar, especially with speculation that the US Federal Reserve could adopt a more aggressive quantitative easing programme at Tuesday’s FOMC meeting. Even if there is no further policy action beyond the US$600bn package announced last month, markets will expect the Fed to voice unease over the recent rise in yields. Potential dollar damage may be limited if the Fed sounds slightly more confident on the economic trends.

The structural US vulnerabilities were illustrated by a warning from ratings agency Moody’s that the US fiscal plans including an extension of tax cuts would significantly increase the risk of a medium-term downgrading of the AAA credit rating. Markets will remain sensitive to the US structural vulnerabilities, particularly given fears over medium-term debt monetisation.

There was relative calm within the Euro-zone during Monday and there was relief that ECB bond purchases in the most recent week were lower than feared. It is also the case that German government officials appear determined to take a more constructive stance towards the Euro. There are still very important vulnerabilities and Euro sentiment will certainly remain very fragile.

With reports of Asian central bank Euro buying and stop-loss dollar selling, the Euro advanced to a high above 1.3430 against the dollar before consolidating just below 1.34 in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar hit resistance below 84.40 against the yen on Monday and dipped sharply in US trading, in tandem with wider losses and hit a low of 83.10 before a tentative rebound.

The US currency was unsettled by a sharp decline in US Treasury bond yields and there was stop-loss selling below 83.50 which triggered further selling.

Overall confidence in the Japanese economy and currency is still weak and there has also been a tentative improvement in international risk appetite which will tend to dampen Japanese currency demand. The yen will tend to weaken if there is a downbeat economic assessment in the quarterly Tankan business confidence survey.

Sterling

Sterling maintained a soft tone in European trading on Monday and retreated to lows beyond 0.8460 against the Euro while it dipped to near 1.57 against the dollar.

The housing data remained weak with the latest RICS survey registering that a net 44% of surveyors reported a decline in prices for November following a figure of 49% the previous month, reinforcing recent negative surveys for the sector.

Bank of England MPC member Bean stated that further quantitative easing could be considered if the EMU developments turned out badly and there were also generally negative comments surrounding the UK banking sector.

The latest consumer inflation data will be watched closely on Tuesday and an elevated reading could provide some degree of initial Sterling support, but it would also risk increasing divisions within the Bank of England and the main influence could be to increase Sterling volatility.

Dollar weakness dominated the US session on Monday and Sterling rallied to a 3-week high near 1.59 before consolidating above 1.5850.

Swiss franc

The dollar was unable to gain any traction above 0.9820 against the franc on Monday and was subjected to heavy selling pressure later in the US session with 1-month lows near 0.9650 before a tentative consolidation. The Euro was unable to sustain a brief move above 1.30 against the Swiss currency.

Moody’s warnings over potential damage to the US AAA credit rating will reinforce structural fears surrounding the Euro and dollar which will also tend to maintain defensive demand for the Swiss currency.

The latest producer prices data was weaker than expected with a 0.2% monthly decline for November which will maintain pressure on the National Bank to resist further franc appreciation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

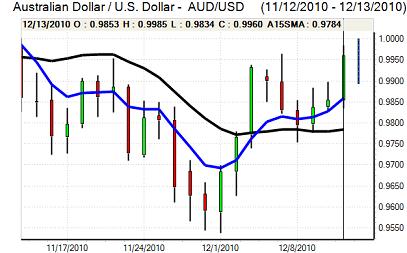

Australian dollar

The Australian dollar took advantage of US currency vulnerability in US trading on Monday and pushed sharply higher with a peak around 0.9980 against the US unit.

Domestically, there was a sharp 13.2% decline in housing starts for the third quarter, although markets had already factored in a sharp slowdown which limited the impact. Caution over the domestic economy is still likely to be a feature and there will also be speculation over a further monetary policy tightening by the Chinese authorities which will limit Australian dollar buying.