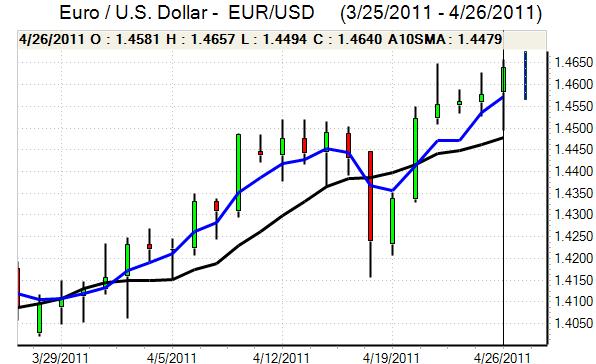

EUR/USD

The Euro found solid support close to 1.45 against the dollar on Tuesday and pushed strongly higher to test resistance near 1.4650. After a partial correction the Euro strengthened to a fresh 16-month high above 1.47 late in the US session as underlying dollar sentiment remained weak with a small rise in US consumer confidence not having a significant impact.

In comments on Tuesday, US Treasury Secretary Geithner took a relatively tough tone on the US currency, insisting that it retains a strong US currency policy. The comments failed to have any beneficial impact with markets assuming that the Administration is content with underlying dollar weakness, but there will be speculation over a more cohesive G7 tone in curbing US losses.

The Federal Reserve FOMC meeting will be an extremely important focus on Wednesday, especially with Chairman Bernanke holding the first quarterly press conference. The Fed is very unlikely to change interest rates at this stage, but comments surrounding quantitative easing will be very important for all asset classes. The most likely outcome is that there will be no extension of quantitative easing beyond June and any announcement that the Fed will not re-invest proceeds from maturing bonds would be supportive for the dollar.

It will still be very difficult to restore confidence in the US currency, especially with market sentiment so negative, but there is also the potential for a covering of short positions and volatility will be high.

The Euro-zone structural considerations will remain very important in the short term, especially with Greek debt estimates revised up again according to the latest data. For now, the markets are still managing to put debt fears aside and concentrate on yield considerations, but sentiment could still turn rapidly given the underlying stresses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to regain the 82 level against the yen during Tuesday and was subjected to renewed selling pressure with a dip to lows of 81.30 early in the Asian session on Wednesday.

The Japanese economic data remained weak with a sharp 8.5% drop in retail sales in the year to March as demand was undermined by the earthquake. Underlying confidence in the economy was also undermined by a Standard & Poor’s announcement that Japan’s AA- rating was being put on negative watch.

Japanese institutions will remain an important influence and the evidence suggests that there will be further investment overseas, especially with the funds generally pessimistic over the yen. Potential capital flows out of Japan will limit the scope for yen gains with the dollar nudging higher on Wednesday.

Sterling

Sterling was unable to make any headway against the dollar on Tuesday and was blocked below the 1.6550 level with a test of support below 1.6450. The UK currency remained under pressure against the Euro with a test of support beyond 0.89.

The latest CBI industrial orders data was weaker than expected, but there was general optimism surrounding the manufacturing outlook.

Bank of England MPC member Sentance maintained his hawkish tone towards interest rates in comments on Tuesday with further calls for higher interest rates. It is, however, significant that he will leave the MPC following the May meeting.

The latest GDP data will be watched very closely on Wednesday, especially as it will have an important impact on Bank of England interest rate expectations. A stronger than expected release would potentially give the central bank greater ammunition for an increase in interest rates. In contrast, a weaker than expected release would trigger further damage to confidence with high volatility a key risk.

Swiss franc

The dollar was unable to gain any traction against the franc on Tuesday and there was a slide to fresh record lows below 0.87 against the Swiss currency late in the New York session as underlying sentiment remained weak.

The Swiss currency maintained a firm tone on the crosses with the Euro strengthening to a high near 1.2750. Investors, in general, have maintained firm interest in carry trades, but the Swiss currency has retained a strong tone which suggests that underlying demand remains firm given its safe-haven role. There will be further support if the Euro-zone debt fears intensify.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

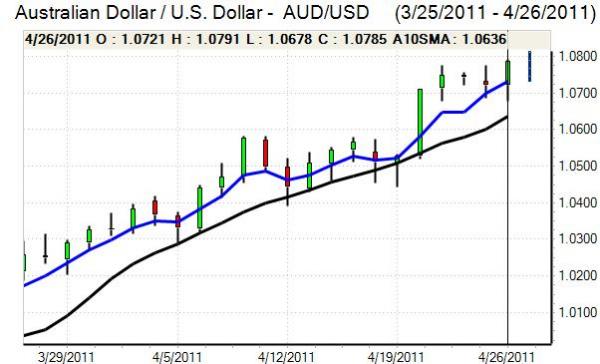

Australian dollar

The Australian dollar found support below the 1.07 level against the dollar on Tuesday and pushed higher during the European session with a challenge on resistance around 1.08 later in New York as equity markets maintained a firm tone.

The currency secured further support from a stronger than expected reading for inflation as consumer prices rose 1.6% in the first quarter of 2011 compared with market expectations of a 1.2% increase. The stronger than expected reading will increase pressure for a further increase in interest rates, although the Reserve Bank is likely to be broadly cautious as the inflation rise may prove temporary.