The economic news keeps coming for Japan and Britain, and not a lot of it is good. It has been interesting to see the strengthening of the Yen against the pound since April.

Post Fukushima, it has been a fairly orderly direction the pair has taken to the Yen side, no doubt on fears of soveriegn and banking collapse in Europe and Britain. While Japan is deep in the red on public debt, they are a nation of savers and many analysts feel as though the risk of economic collapse before the Tsunami and Nuclear disaster were somewhat remote. While the hit to Japan’s economy was substantial and will continue to affect the country, the current reality is that Japan is holding steady and seeing some modest improvements in their economic indicators.

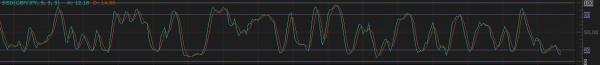

I graphed a Fibonacci retracement on the pair since the Tsunami and you can see that weakening of GBP to the Yen has steadily moved past lowest support. What had been support at 122.207 has now become short term resistance to the upside.

Sept 15’s morning trading has been to the upside. The question is, will the pound continue to rally to the upside confirming long-term support at 122.207, or will the trend continue to the downside upon fears of sovereign and banking contagion?

Economic Indicators

Economic indicators this week have been clearly on the side of the Yen. Japanese industrial and manufacturing reports have been supportive of expectations, while British visible trade balance and retail price indexes have been misses. Jobless claims in Britain were favorable, however. Next week is a big news week for the pair. Bank of England minutes, public sector borrowing, oY housing prices, and loans for house purchases are on the docket for the Pound. The Yen will see the JPY leading index, merchandise trade balance, and all industry activity index news.

In two weeks, Japan will release data on retail sales, housing starts, jobless rate, household spending, and consumer price index news while Britain will announce consumer confidence, mortgage approvals, consumer credit, and nationwide house prices. September is an important pivot month for the pair as economic indicators and the playout of banking sector troubles in Britain will put pressure on the currency pair. Continuing supportive numbers in the Japanese indicators along with deteriorating data in Britain could continue to push the pair to the downside, and that is what many analysts are expecting.

Stochastics show the shorts have moved into oversold territory with a possible breakout to the upside possible. Any value below 20 is potentially bullish to the upside.

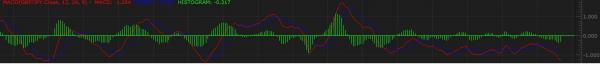

The MACD is continuing bearish and continues momentum below the signal line.

Both are rear looking indicators and may not point the direction forward, however.

Trader sentiment with my forex broker reached a ratio of 16:1 long buyers to short, but has since decreased to 11:1, correlating with this morning’s move to the upside as traders expect reversal above 122.207 support. However, trader sentiment is typically a contrarian indicator at levels above 3:1. Therefore, sentiment indicator also indicates a move to the downside could be coming.

With calls for double dip recession deepening in much of the West, and the worst of the bad Japanese news in the rear view mirror, my hunch is that the pair will continue to trade lower but within a reasonable range below 122.207. If banking fears are assuaged in Europe and Britain and Greece somehow avoids meltdown sending Europe into a tailspin, the pair could reverse to the upside. But my hunch is the economic data continues to get worse for Western nations while the recent bad news out of Japan gets relatively better than before.