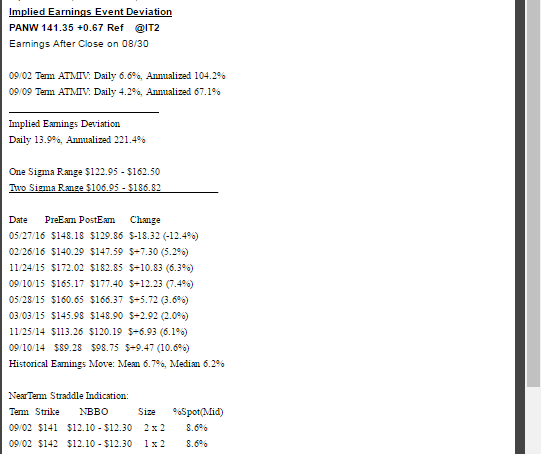

Palo Alto Networks (PANW) has been a favorite of ours for the past few years. It had a rough go of it last earnings cycle though. They reported a 3rd Quarter April 2016 loss of $0.16 per share on revenue of $345.8 million. The consensus earnings estimate was $0.42 per share on revenue of $339.5 million. The Earnings Whisper number was $0.43 per share. Revenue grew 47.7% on a year-over-year basis. The stock tumbled 12.4% as margins really took a hit.

The company said it expects fourth quarter non-GAAP earnings of $0.48 to $0.50 per share on revenue of $386.0 million to $390.0 million. The current consensus estimate is earnings of $0.50 per share on revenue of $389.3 million for the quarter ending July 31, 2016.

But, it should be noted that this may have been a one-off situation. Over the past two years, PANW has gone up on earnings seven out of the last eight times.

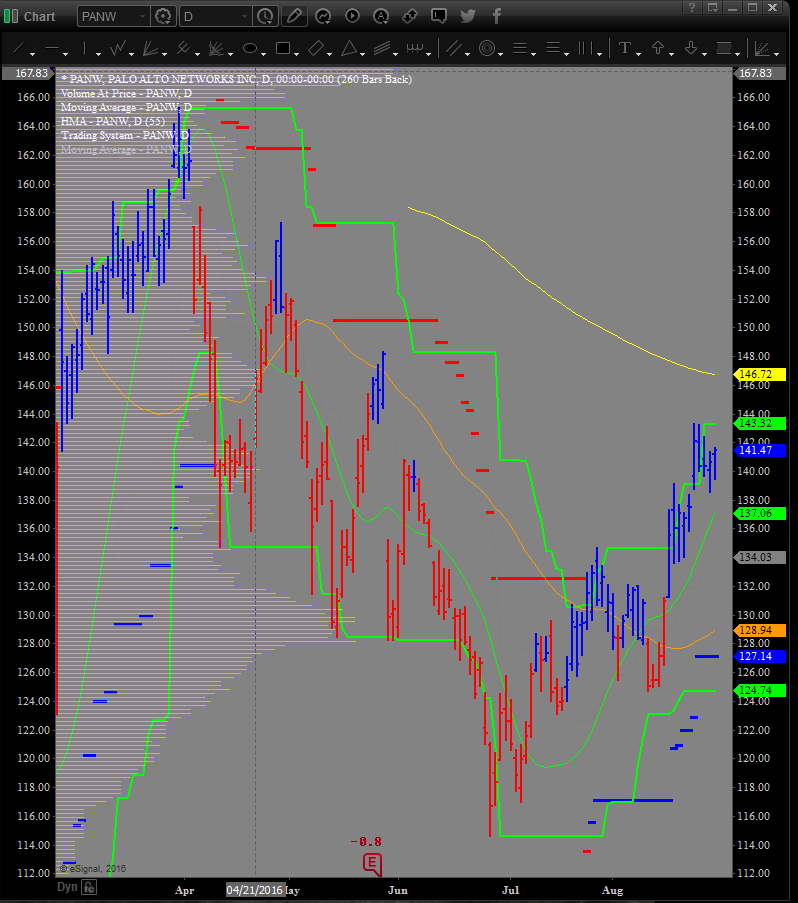

Add to that a strong chart that filled the gap created from the last earnings release:

Add to that the performance of their two closest sector-mates Cisco Systems (CSCO) and Barracuda Networks (CUDA) both fared well on their last earnings report.

In short, all signs point North and we signaled:

8-29-16: Based on our methodology a signal has been generated:

Sell (opening) the PANW September 2nd WE 155 strike call

Buy (opening) the PANW September Regular Expiration 155 strike call

For a debit of $0.65 or less.

This signal is not GTC, is a DAY ORDER ONLY and is valid with PANW trading $141.50 – $143.50.

This is what the risk graph looks like for our modeled implied vols: