This time of year, I think grains markets offer some great opportunities for traders as the growing season begins and everyone is watching the weather. Right now, I’m particularly bullish on the prospects for corn, which has seen planting delays, and recommend a call spread as a possible trading strategy.

If the weather is perfect early in the year, farmers would have no disruptions and get their product in the ground and harvest it. However, that’s often not the case, and in the past couple of years we’ve seen longer cold weather patterns into spring combined with heavy rains that have resulted in planting delays. Farmers have been scrambling to get their crops in the ground this year. There has been a lot of rain in the Midwest this spring, although not nearly as bad as last year when we saw the price of corn rally to $8 a bushel.

The USDA crop progress report for the week ending May 17 showed corn planting at 62 percent, compared with 70 percent last year. The10-year average for crop in the ground by this time in the season is 82 percent. In Illinois, the crop is only 20 percent complete, well below the 10-year average of 86 percent. So we have some 9.76 million acres in Illinois which may be planted after the optimal yield date. To me, that lends support to bullish price action as the later the corn gets in the ground, the more vulnerable the immature crop is to summer heat, as well as the prospect of possible frost exposure heading into harvest.

The latest Commitments of Traders Report, released weekly by the Commodity Futures Trading Commission, showed funds were net buyers of 55,794 contracts. These trend-followers increased their net long exposure to more than 64,000 contracts and that shows these market participants are also anticipating higher prices.

Any news of slow progress or bad weather as we continue into the growing season will lend support to buyers. In the past few years, we’ve seen back-to-back limit moves on consecutive days in the corn market at this time of year as the markets are highly sensitive to fundamentals. (The daily limit is 30 cents for corn futures.)

If you trade grains, it’s important to not only watch the weather and crop progress reports, but also outside markets such as the U.S. dollar, which also tends to drive commodity price action as most commodities are priced in dollars. Before the grains markets open, you can watch activity in the dollar as well as crude oil and the stock market to help gauge direction. As an energy source as well as a food source, corn often tracks the price of crude oil.

Of course, the U.S. Midwest is not the only place that produces grains, and I don’t think we will have the exact same market spikes as we saw last year in grains, which saw record highs amid widespread commodity inflation. So far, this market hasn’t been trading in as big a range this year as we saw last year. But it does seem that given the planting delays we’ve had this year, conditions are bullish again this year for corn. We’ve had less-than-perfect weather, and some farmers who can’t get their corn into the ground may shift to soybeans or other crops which can be planted later.

While I’m bullish, that’s not to say the market will go straight up. There may be days crude oil is down and the stock market pulls back, and that does impact grains markets as well. Right now I recommend bull call spreads, as well putting on strangles.

Right now, a good play would be to look at September calls in corn. With a call, your loss is defined as what you pay for that option, while your opportunity on the upside is virtually unlimited until expiration. You can also sell a call against it to make the trade even more affordable. Don’t necessarily come in and buy at the highs, wait until the market pulls back a bit to give you an opportunity a better price. Keep in mind that every penny in corn is worth $50.

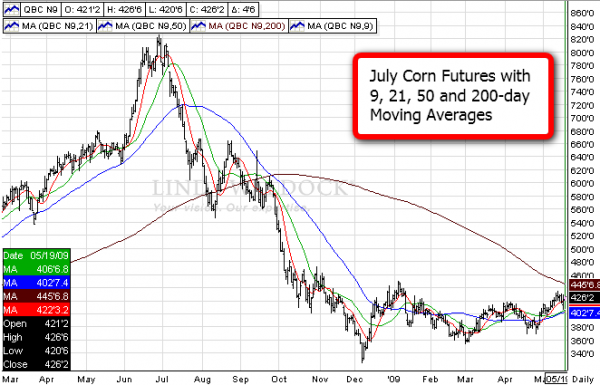

As far as technicals, I see support for July corn futures at $4.02 and $3.95, with resistance at $4.27 . Once we break that, I’d look for $4.50 as the next upside target, so a $4.50 call might be worth considering. After that, there is a big gap near $5 and I thik there is a lot of opportunity for more upside. July corn settled at $4.21 1/2 on Monday, May 18, 2009.

Please feel free to call me with questions about this topic, or to develop a customized strategy for your particular risk-tolerance and account size.

Brian Booth is a Senior Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division. He can be reached at 800-993-6601 or via email at bbooth@lind-waldock.com.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Futures trading involves substantial risk of loss and is not be suitable for all investors. 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL60604.