I believe there is no other term used more widely, or that prompts more thoughtful head nodding in wise agreement, and yet is so poorly defined, as “long-term.”

Any time I see mutual fund descriptions or “About Us” website pages that tout their “long-term focus,” I immediately substitute “we plan to lose money.” It’s one thing to have a pull-back after a long string of gains, but it feels very different if you are the last person to invest before one of those “in it for the long-term” lectures is necessary.

WHAT DOES IT REALLY MEAN?

So what do we mean by long-term? Many people use this to mean the last 75 or 100 years of the stock market, or since Dow Jones began tracking performance. Besides being completely irrelevant to anyone’s investment horizon, these very long periods invite manipulation by allowing a specific starting date to be chosen.

PERIOD OF TIME MATTERS

When praising the long-term performance of the market, the starting date is almost always a particularly low point in the past. Another popular timeframe is the last 30 years, with a typical starting point around 1980 or 1981. Perhaps this is a more relevant timeframe, but it happens to include two decades of ridiculous growth in the stock market that, for several reasons, is unlikely to be repeated anytime soon, if ever.

Ten years has often been quoted as being a sufficiently safe period of time to own stocks. However, many buy-and-hold investors today have now experienced a 13-year period of zero growth, and losing perhaps a third of your investing lifetime can be devastating to retirement goals. Any notion of safety that long-term investors in the Japanese market had has long since gone out the window. The truth is that “long-term” often means whatever timeframe is long enough to make you ignore the fact that money can or is being lost in the short-term.

NOT MUCH ALTERNATIVE TO STOCKS

Despite the risk, there aren’t a lot of alternatives to stocks that can achieve the kind of returns most people are counting on to meet their retirement goals.

Bonds won’t do it with interest rates near zero, and trying to time the market in order to avoid big losses and participate in uptrends is next to impossible when so many of the catalysts that move the market are one-time or sudden events, often occurring when the U.S. market is closed.

I’ll admit that I’m no good at guessing which stocks are the next winners or losers, so one solution for those of us who are directionally-challenged is to play both sides of a trade.

BUY SOME INSURANCE

Buying stock is a bet that the stock price will go up in the future. It also means that you own an asset that could lose value. For other valuable assets, such as a house, most people buy insurance. If the house burns down or some other calamity causes the value to drop, the insurance company is obligated to make the policy holder whole for as much as the house was insured for, and provided the policy hasn’t expired.

USE A PUT

This sounds a lot like a Put option. A Put option insures the underlying stock at a certain value (the strike price), and the “policy” has a certain expiration date. The common argument against insuring stock is that Put options cost money and create a drag on performance. You seldom hear this argument when the subject is fire insurance and someone’s house. In any case, we can do better than simply limiting losses.

DOUBLE UP

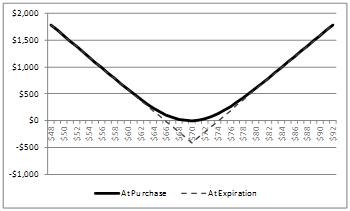

Imagine if you were able to buy two insurance policies for your house. If the house burns down, the first policy would replace the cost of the house, and the second policy would make the homeowner a bunch of money. Of course, if you were able to do this, everyone would want their house to burn down over and over again, so no insurance company would allow it. But this doesn’t hold true for Put options. There is no restriction that prevents you from doubly insuring your stock. By purchasing two at-the-money Put contracts for every 100 shares of stock, a “straddle” is created that produces a profit curve like Figure 1.

This example assumes 100 shares of stock are purchased at $70. When first initiated, the position has the potential of profiting regardless if the stock price goes up or down. In other words, it is direction-neutral. Notice that the risk of a straddle position is not that the underlying stock price could lose value, but that it stays roughly the same while the Put “insurance policies” head toward expiration.

MAKE REGULAR ADJUSTMENTS

The key to participating for the long-term in this position is to make regular adjustments. Let’s say that after purchasing this $70 stock, the price promptly drops to $64. As you can see from Figure 1 the position would be profitable, but it would also no longer be neutral.

If the stock reversed course and headed higher, the position would begin giving up profit. To eliminate this problem and lock in the profit, the position must be rebalanced and brought back to neutral. The reason the position has a profit even though the stock price dropped is that the two Put contracts gained value faster than the shares of stock lost value.

BRING INTO BALANCE

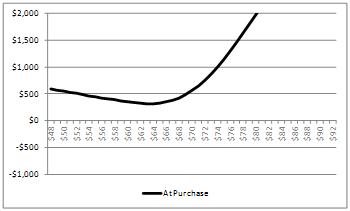

The two sides can be brought back into balance by either selling Put contracts or purchasing more stock, and herein lies the reason the straddle is created with Puts and stock as opposed to the more familiar Puts and Calls. Option contracts only trade in chunks of 100, so by implementing one side of the straddle with stock, the adjustments can be much more granular. Purchasing an appropriate number of stock shares results in the profit graph seen in Figure 2.

LOCK PROFIT IN

At the new stock price of $64, the profit is locked in and the position is again neutral, meaning it will gain more profit whether the stock price moves incrementally up or down. However, it is no longer symmetrical. Because there are now more shares of stock and the same number of Puts, the position will gain at a much slower rate if the stock price continues to fall. However, it is also poised to make gains even faster if the stock were to recover, in which case it could be balanced again by selling an appropriate number of shares. As long as there is stock movement and the Put options are periodically rolled to a further month (i.e. the insurance policies are extended), this technique can be used indefinitely with only the cost of the Put options ever being exposed to risk.

IT CAN WORK FOR THE LONG TERM

It’s obviously not a “set it and forget it” strategy, but it can work for the long-term, no matter what your definition of “long-term” is.

#####