Today:

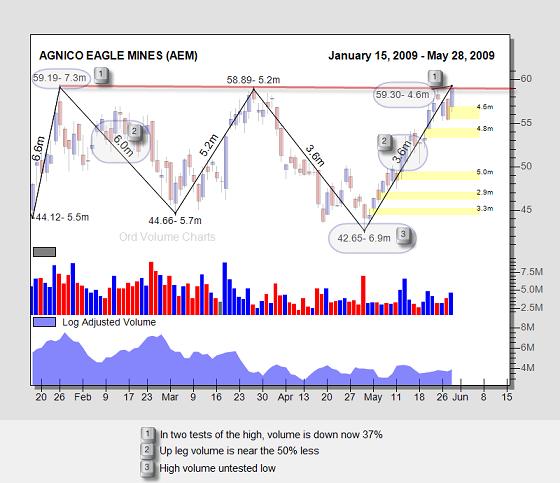

We have showed three gold stocks this week that show signs that their rally is over. When everyone says your hurt you should lie down. When you get this many stocks in a sector all telling the same story you better pay attention. The warning signs are here.

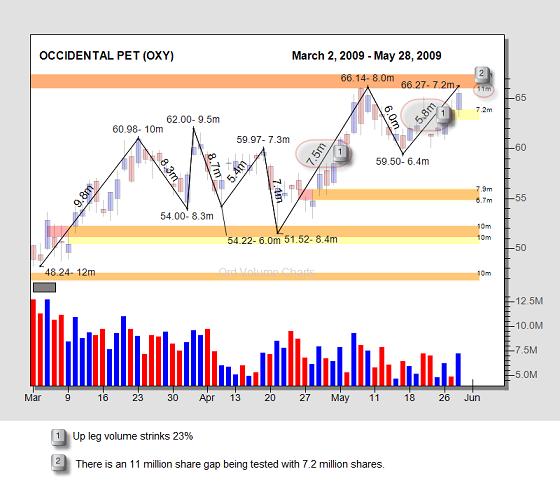

There are hundreds of stocks testing high volume gap downs from last fall. Our Oxy chart in the examples is a good representation of a lot of stocks we have looked at this week. We suspect that there is very little upside from here. Usually these turn with a quick sharp spike that stops out the shorts leaving very little in the way of support on the way back down. We are looking for a very scary spike up with light volume. These normally don’t last a day. This will signal a top is in place and we have started some kind of trading range where the market starts a long consolidation hopefully to build the next bull market.

Examples:

Understanding Examples:

Examples shown are starting points for looking for a trade. The market, sector and stock should all be telling the same story to enter a trade. An example of a stock is just 25% of the story, you still need to get the broad market (50%) and sector (25%) to line up. SOS stands for “sign of strength”, a big candle (big price change) where volume is significantly higher and instantly stands out on the chart.

Newsletter Information:

Proving the Point is published each trading day exclusive of the last two weeks of August and December. Questions can be addressed to help@ord-oracle.com. The term “Proving the Point” comes from a term coined by the original evangelist of price and volume trading, Richard Wyckoff. The term refers to when a stock goes through a previous swing with significantly less volume and pops back into the trading range defined by the previous swings. It has proved the point that there was no demand for higher prices or supply for lower prices, at that time.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable, there is no guarantee results will be profitable. Not responsible for errors or omissions. We may or may not invest in the vehicles mentioned above. Copyright 2009 Ord Oracle.