It’s been a week since we stated on CNBC that the market has an 80% chance of hitting 1220-1250 and market is now holding 1220. The next level we could see from a technical perspective is 1227-1229, then big resistance is 1235, and major at 1240-1244

Tech

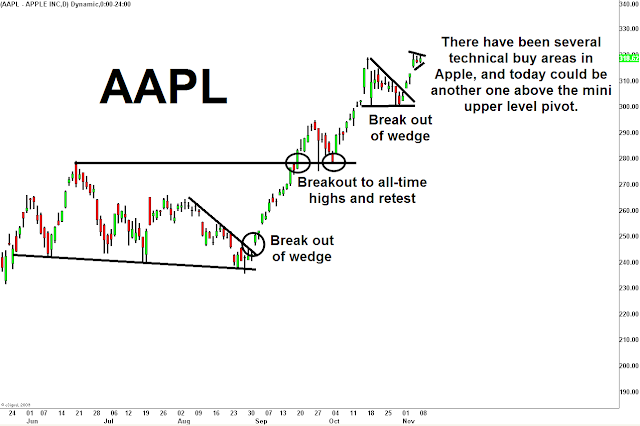

Apple Inc. (Nasdaq:AAPL) has held very well the last few sessions as we targeted buying this at 304-306 as it broke its mini downtrend. If we can take out the 120.18 highs, it should provide a great cash flow trade but has been tricky lately.

Baidu.com, Inc. (Nasdaq:BIDU) is resting well after the earnings move to 114ish. I am looking to potentially buy some if it clears the recent pivot of 111.30-111.50.

Amazon Inc. (Nasdaq:AMZN) made new highs yesterday and can continue, but I’m not trading it.

Google Inc. (Nasdaq:GOOG) gives us a nice trade for about 30 minutes each time we list it, then it trickles. I’m flat here, but I might take some if it can clear 629-630 today.

Netflix, Inc. (Nasdaq:NFLX) has been VERY Quiet of late. It’s hovering above its 21 day moving average and its earnings gap. I will watch it closely. I will likely buy some if it can clear 171-173 to get back on the move.

VMWare, Inc. (Nasdaq:VMW) finally woke up from its recent slumber. I’d see if it can continue as some of these Cloud stocks have been repairing. F5 Networks, Inc. (Nasdaq:FFIV) and salesforce.com, inc. (NYSE:CRM) are also moving a bit better.

Sohu.com Inc. (Nasdaq:SOHU) and SINA Corporation (Nasdaq:SINA) are two stocks that I had on my price point sheet all last week, and they FINALLY stretched yesterday through those listed buy prices. I was away from my trading desk and missed them, though.

Banks

Goldman Sachs Group Inc. (NYSE:GS) made a stealth move back above 171 and now needs some time here. I’d avoid GS for the time being as it rests and consolidates.

Bank of America Corp (NYSE:BAC) was a nice catch up trade for those who saw the volume come in 11/04 around 11.80-12.20. It now seems like it should work its way to fill gap to about 13.20ish.

JPMorgan Chase & Co. (NYSE:JPM) ignited on 11/4 and blast through the lower downtrend of 38. Now it’s hovering in front of big resistance around 41-41.50. See if it pushes through this level. If so, the market could get another push.

General Electric Company (NYSE:GE) is now building a small flag and could continue to fill gap into low 17’s, but it’s very slow.

Casinos

Wynn Resorts, Limited (Nasdaq:WYNN) was listed as a buy around 95-96 for a measured move to 115. It’s now above that level and is tricky. I’d just keep it small.

Las Vegas Sands Corp (NYSE:LVS) has been an absolute monster. It was a painful process trying to catch the day and half short. I net lost money. Some may have been more patient than I and caught that Friday big reversal and covered yesterday into the down open. You had to be almost perfect. Right now there are easier set-ups out there so my focus will be elsewhere. If you’re still short I would use the 55.47 as your stop. I will look for it to wedge and then pick a direction.

MGM Resorts International. (NYSE:MGM) had igniting bars and, by definition, ignited for a big move. On 11/3 this stock got put back in the game as it broke lower downtrend on massive volume. Yesterday it broke above a mini flag and could see higher prices still.

China MediaExpress Holdings Inc (Nasdaq:CCME) has had a big move, the stock hit 22 yesterday! I was done with it at 14 and thought I held it well. You should only look to trade it now on a short term intraday basis.

Here are a few speculative type Chinese mid-cap plays.

Yongye International Inc. (Nasdaq:YONG) has a nice chart and looks Ready to break out above 9.10-9.20. I am long tier 2 and will add if I see big volume.

Yuhe International, Inc. (Nasdaq:YUII) also has a nice chart plus solid fundamentals. I’m long tier one and will add above 9.50.

ChinaCache International Holding Ltd. (Nasdaq:CCIH) I mentioned this stock last week against the lower end of its range. Now it’s toying with its pivot buy around 28-28.50.

SPDR Gold Trust (ETF) (NYSE:GLD) is above $138 has spot gold eclipsed $1400. It seems like yesterday it was 2008 and I told Marc Haines it will see $1300-$1500. That’s when Dennis Gartman said on the 2:00 show by Erin Burnett that he disagreed with Scott Redler about Gold, and basically insinuated that if I made that prediction then I didn’t agree with the American Way of Life. Well, I don’t have opinions, I just see what is setting up in front of me. The proof is in the pudding. Silver has even outperformed Gold and iShares Silver Trust (ETF) (NYSE:SLV) looks somewhat extended now after the recent break out. I have not been trading it but some have mentioned looking for a calculated short in the $30 area.

At this point, there are no signs this rally has any signs of abating. We are in an inflationary environment with a ‘Fed Put’ in place and the economy is starting to show signs of improvement. That doesn’t mean you wildly throw all your money to the long side of high-momentum equities, but you need to diversify your money across assets that stand to benefit in the current environment. As the rally continues, protect your gains and play additional set ups with a less size. There remains a ton of opportunities as money continues to rotate.

*Disclosure: Long AAPL, GOOG, YONG, GE, MGM, YUII