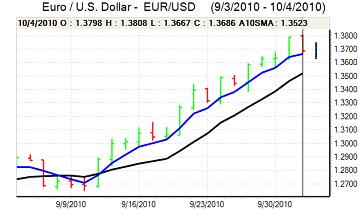

EUR/USD

The Euro again found support above 1.3650 against the dollar during Tuesday. The Euro-zone data did not have a major impact with a stronger than expected PMI services report for the services sector offset by a weaker than expected retail sales report.

The US economic data was slightly stronger than expected with a rise in the ISM report for the services sector to 53.2 from 51.5 previously. The employment component edged back above the 50 level which will increase confidence over a gain in jobs in the Friday employment report, but there will be little optimism surrounding the release. Overall, the recent data will tend to lessen fears over a renewed slide into recession, but will not be strong enough to alleviate speculation over further quantitative easing.

There were further very dovish comments from Regional Federal Reserve President Evans who stated that he wanted much more quantitative easing. The remarks will reinforce expectations that the Fed will make a move at the November meeting even though Evans is not a voting member.

Following action by the Bank of Japan and expectations of action by the Fed, the Euro tended to gain by default with expectations that the ECB would be less aggressive towards quantitative easing. Nevertheless, the bank will still be buying peripheral bonds and there are still substantial risks surrounding the Euro-zone financial sector.

Hopes for global economic support triggered renewed selling pressure on the dollar and the US currency weakened to fresh 8-month lows beyond 1.3850 against the Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Bank of Japan was more aggressive than expected in its policy decision on Tuesday. The central bank cut interest rates to a 0.0-0.1% range from 0.1% and also announced a further expansion of its balance sheet. The move was described as comprehensive monetary easing by bank governor Shirakawa.

The dollar pushed to a high near 84 against the Japanese currency with some exporter selling emerging at higher levels which curbed the yen retreat. The Australian central bank decision to hold interest rates steady at 4.50% also discouraged flows out of the yen to some extent.

The dollar quickly surrendered the gains and weakened to lows near 83 as yield support remained weak. Fears over intervention by the Bank of Japan curbed more aggressive selling of the US currency and markets will remain on high alert over further bank action.

Sterling

Sterling again found support on retreats towards 1.5750 against the dollar on Tuesday and advanced to a two-month high near 1.5930 during the US session.

As far as the UK economic data is concerned, there was a rise in the PMI services-sector index to 52.8 for September from 51.3 previously. The report provided some relief over the outlook, although it was still relatively week with particular disappointment surrounding the orders reading.

The net effect was to dampen expectations that the Bank of England would sanction an expansion of quantitative easing at this week’s MPC meeting which provided some degree of Sterling support.

The main catalyst for Sterling gains was still general dollar weakness with further speculation over Federal Reserve action also providing indirect support to the UK currency. The UK currency was weaker against the Euro with a renewed test of support weaker than 0.87.

Swiss franc

The Euro found support below 1.33 during the franc on Tuesday and pushed to highs near 1.34 before stalling. A weaker franc trend cushioned the dollar to some extent, but it still tested fresh 30-month lows below 0.9650.

Global risk appetite was generally firmer which curbed immediate franc support as equity markets rose and there was optimism over central bank action to boost growth.

From a longer-term perspective, there will be increased fears that further quantitative easing will ultimately lead to weaker currencies and the franc will continue to gain support from expectations that the National Bank is more likely to resist these pressures.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

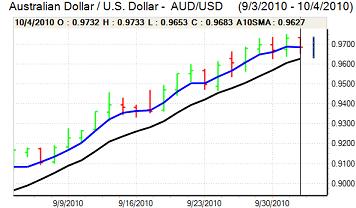

Australian dollar

The Reserve Bank of Australia left interest rates on hold at 4.50% following the latest policy meeting on Tuesday, contrary to expectations of an increase to 4.75% and this pushed the currency sharply weaker with lows below 0.9550 against the US dollar.

Caution over the international growth outlook will be offset to some extent by expectations that there will be further action by the G7 central banks to boost economic activity. The expectations of Fed easing will be particularly important in curbing Australian dollar selling pressure. Wider US currency weakness dominated during New York trading with the Australian dollar recovering strongly to test resistance near 0.9725.